Higher gas prices likely pushed up inflation in August, though other costs probably slowed

A sharp increase in gas prices likely pushed inflation higher in August compared with a year ago, yet a measure excluding energy and food costs is expected to fall for the fifth straight month, suggesting that the Federal Reserve’s interest rate hikes are still bringing down prices for many goods and services

2023-09-13 12:25

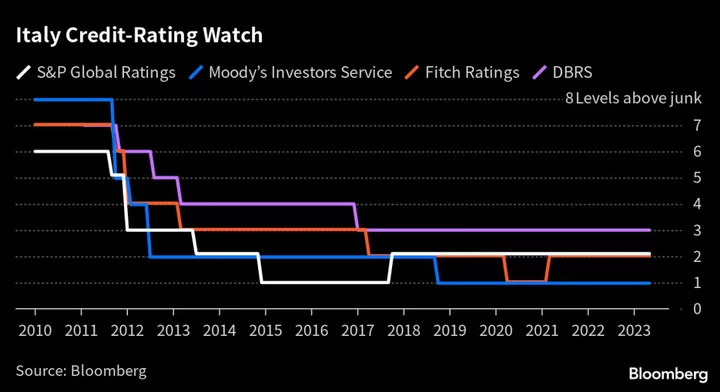

Italy Avoids Moody’s Downgrade in Boost for Meloni

Italy won’t lose its investment-grade status at Moody’s Investors Service for now after the company chose not to

2023-05-22 17:47

They said we were getting a recession. Instead, we're getting a bull market

What do you get when you mix recession fears, interest rate hikes, a spending slowdown and a housing crunch? A recipe for a bull market, apparently.

2023-06-07 19:48

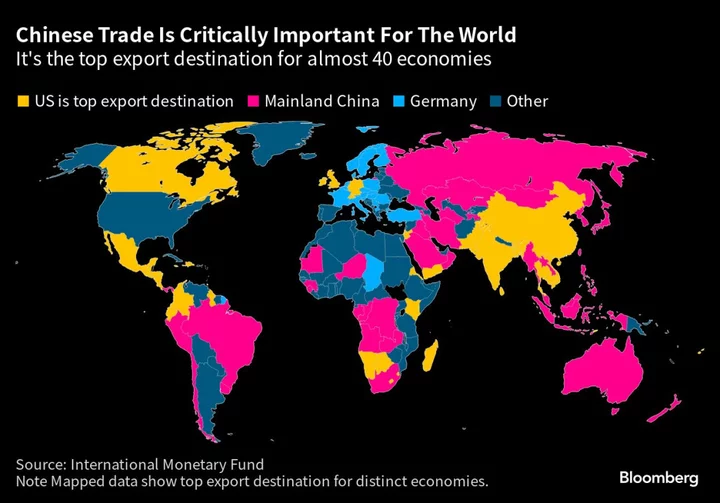

US tightens curbs on AI chip exports to China

The United States on Tuesday said it was tightening curbs on exports of state-of-the-art AI chips to China, sending the share price of Nvidia and other...

2023-10-18 01:21

It was a big week for interest rates. Here's what you need to know

Central bank officials around the world relayed a somewhat unified message this week to the global economy: Inflation is coming down, but the battle is far from won.

2023-09-22 19:55

Exclusive-Emirates tells Rolls-Royce: Go back to basics, put products first

By Tim Hepher PARIS (Reuters) -The head of Dubai's Emirates has urged Rolls-Royce to go "back to basics" and focus

2023-11-29 21:20

New Zealand Set to Remain OECD Outlier Without Monthly CPI

New Zealand looks likely to remain the sole OECD nation without a monthly inflation report for some time

2023-05-16 08:56

China Evergrande says improved internal control may address listing rules

Embattled property developer China Evergrande Group said on Monday the measures it had taken to improve its internal

2023-08-21 22:52

Hong Kong home prices drop for third month in July, down 1.1%

HONG KONG Hong Kong private home prices eased 1.12% in July from June, the third monthly fall in

2023-08-29 10:50

Geoff Cook Joins Noom as Chief Executive Officer

NEW YORK--(BUSINESS WIRE)--Jul 18, 2023--

2023-07-19 00:48

Henry Schein Congratulates Dr. Louis W. Sullivan for Receiving a 2023 National Humanism in Medicine Medal, Awarded by The Arnold P. Gold Foundation

MELVILLE, N.Y.--(BUSINESS WIRE)--Jul 10, 2023--

2023-07-10 18:48

US May Impose Higher Capital Requirements on Big Banks, WSJ Says

Large lenders in the US may face a 20% increase in capital requirements in the aftermath of a

2023-06-05 13:29

You Might Like...

Stocks Drop 20% If Bonds Have Inflation Right in JPMorgan Model

New cars are supposed to be getting safer. So why are fatalities on the rise?

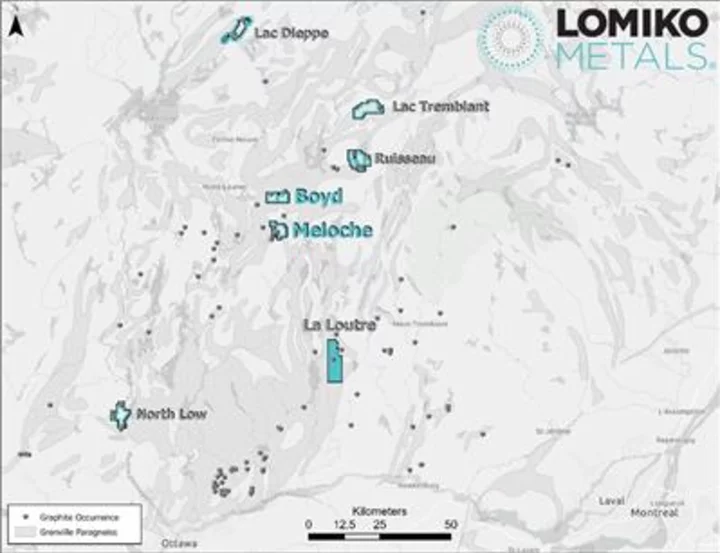

Lomiko announces update on its regional graphite exploration program in the Grenville region, Quebec

Charting the Global Economy: US Soft Landing Case Grows Stronger

HPE Slips After Giving Disappointing Cash Flow, Profit Outlook

Judge in Trump Special-Master Review Assigned to New DOJ Criminal Case

All You Can Eat Boneless Wings are Back at Applebee’s!

Exclusive-Japan robot maker Yaskawa eyes $200 million US investment