Avangrid Hosts its First Ever Supplier Diversity Summit

ORANGE, Conn.--(BUSINESS WIRE)--Oct 12, 2023--

2023-10-12 21:58

Dick's Sporting Goods blames 'increasingly serious' theft problem for profit plunge

Dick's Sporting Goods warned Tuesday that retail theft is damaging its business and would lead to lower annual profits.

2023-08-23 00:22

H&M Blames Weather for Flat Sales as It Lags Behind Zara

Hennes & Mauritz AB blamed poor weather for flat second-quarter revenue as the Swedish retailer keeps lagging competitor

2023-06-15 14:55

Dollar General Celebrates Blair, Nebraska Distribution Center Grand Opening

BLAIR, Neb.--(BUSINESS WIRE)--Aug 19, 2023--

2023-08-20 04:46

Vishay Honors Mouser With Top Awards for Distribution Excellence

DALLAS & FORT WORTH, Texas--(BUSINESS WIRE)--Jun 14, 2023--

2023-06-14 21:17

Swedish Landlord SBB Sells Some Properties to Reduce Debt

The face of Sweden’s property crisis has sold some properties to a municipality to strengthen its financial position.

2023-06-30 21:28

Hearings in $1 billion lawsuit filed by auto tycoon Carlos Ghosn against Nissan start in Beirut

Lebanese judicial officials say hearings in the $1 billion lawsuit filed by auto tycoon Carlos Ghosn against Nissan and other defendants have started in Beirut

2023-09-19 01:59

Japanese equities draw huge foreign inflows amid easing Fed rate hike fears

Foreign investors were major buyers of Japanese equities last week, buoyed by robust corporate earnings and a broader

2023-11-16 16:25

Japan lobby head urges BOJ to normalise policy to live with interest rates

By Tetsushi Kajimoto and Kentaro Sugiyama TOKYO An outspoken leader of a Japanese business lobby said on Thursday

2023-11-09 19:26

Applebee’s Introduces NEW Holiday Combos

PASADENA, Calif.--(BUSINESS WIRE)--Nov 13, 2023--

2023-11-13 21:27

Japan’s Green Switch Falls Short of Global Goals, Climate Researchers Say

Japan’s planned transition toward cleaner energy contradicts pathways recommended by a United Nations body to help keep global

2023-11-14 09:29

Canada's housing crisis will take years to solve -finance minister

An affordable housing crisis that is hurting the Canadian government's popularity will take years to resolve, even if

2023-09-17 04:57

You Might Like...

Nigerian leader plans $10 monthly handout to poor households after gas subsidy ends

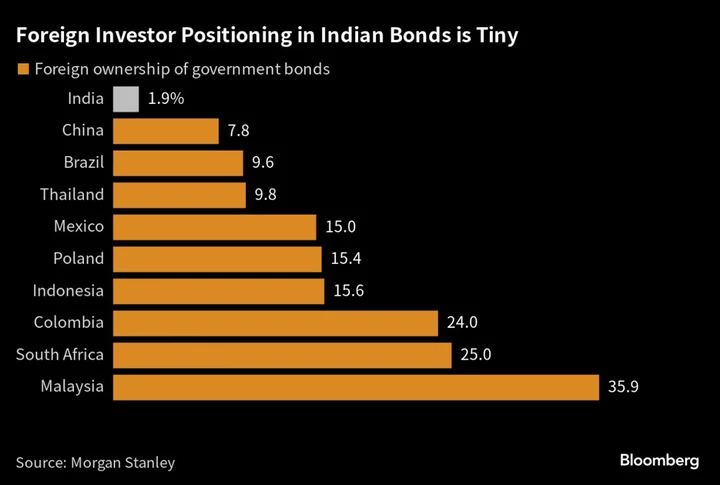

Foreigners Set for Bigger Play in $1 Trillion India Bond Market

Texas heat brings the state's power grid closest it has been to outages since 2021 winter storm

Exclusive-Walmart, Centric probe suppliers for potential links to Cambodia women's prison

Why American communities are suing Big Oil for climate damages

China Looms Large as NATO Allies Debate Expanded Role in Asia

Australia's home prices hit record high -CoreLogic

Where is Captiv8 based in? Ad firm behind Bud Light-Dylan Mulvaney fiasco fires 13 employees after senior execs' luxurious French trip