Goodyear Tire & Rubber Co. announced a flurry of leadership changes this week as part of a sweeping transformation plan designed to cut costs after months of pressure from activist Elliott Investment Management.

Shares of the tire manufacturer rose 2.8% on Wednesday, the day the changes were announced. Since Elliott started its campaign, the stock has risen nearly 20%, according to data compiled by Bloomberg.

It’s the latest win for Paul Singer’s multi-strategy investment firm, known for amassing stakes in beaten-down companies and pushing for leadership and strategic changes to boost shareholder value.

Read more: Goodyear’s CEO to Step Down Alongside Activist-Driven Overhaul

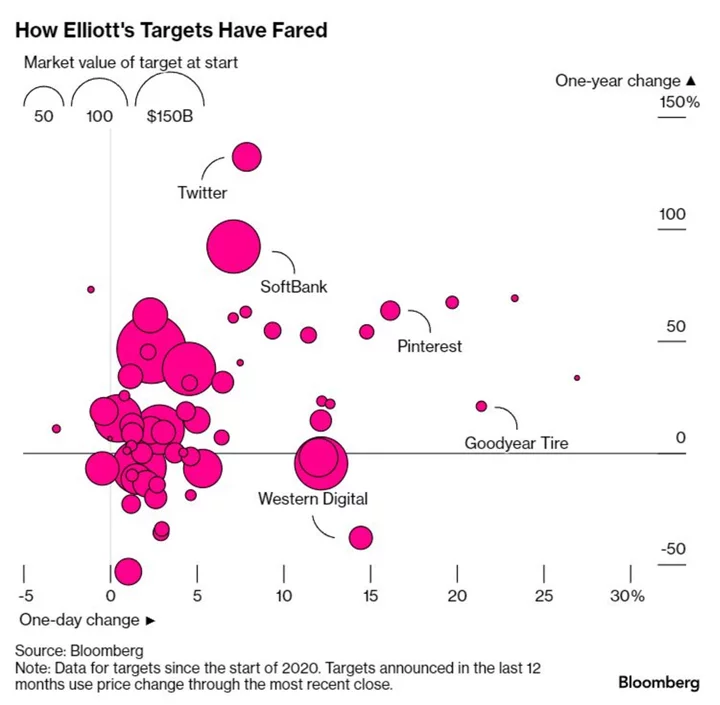

Investors of Elliott targets generally end up happy - most of the shares of the about 60 companies the firm has engaged with since 2020 gained the day it became known the activist had built a stake. And, one year later, most company stocks were still higher even if Elliott no longer held shares, according to a Bloomberg analysis of companies tracked by Bloomberg Intelligence. A spokesperson for Elliott declined to comment on the firm’s track record.

Here’s where other major investments from the firm stand:

Salesforce

Bloomberg reported in in January that Elliott took a substantial stake in Salesforce after the enterprise software company slumped in 2022. In March, the company avoided a proxy fight — Elliott decided not to proceed with planned director nominations — due to solid fiscal year 2023 results and strong fiscal year 2024 transformation initiatives. Though the stock is far from its 2021 peak, shares have made solid gains in 2023.

PayPal

Elliott took a stake in PayPal in 2022 after a slowdown in growth in payment volume on the platform sent shares tumbling from its 2021 all-time high. An August filing showed that Elliott no longer held PayPal shares at the end of June. The stock is down about 20% for the year.

SoftBank

SoftBank jumped when news broke in February 2022 that Elliott had built a stake in the company and had privately engaged with the firm’s leadership and was working on solutions to help it reduce its discount to intrinsic value. The company planned a $4.8 billion buyback on Elliott’s urging, and even discussed going private with the investor. Reports in August 2022 that Elliott reduced almost all of its SoftBank stake sent shares lower.

In early 2020, Bloomberg reported that Elliott Management took a sizable stake in then-Twitter and planned to push for changes at the social media company, now called X. Later in the year, Elliott and private equity firm Silver Lake reached an agreement with Twitter that the company would appoint three new directors to its board as well as create a committee to review its leadership and governance. One of those board seats went to Jesse Cohn, a managing partner at Elliott. Filings show that Elliott had exited its stake in Twitter by the end of June 2022. Elon Musk bought the company in April 2022.

Western Digital

Elliott called for Western Digital Corp. to separate its flash business and undergo a full strategic review in May 2022 and offered $1 billion in incremental equity capital to help facilitate the separation. In January 2023, Elliott along with Apollo Global Management led the purchase of $900 million of convertible preferred stock of Western Digital. At the same time, Western Digital and Elliott revised a June 2022 letter agreement to provide the activist a board set under certain conditions. The stock is up almost 50% year to date.

Catalent

Catalent shares rose when it said in August that as a part of a settlement with Elliott it will add four new members to its board and undertake a strategic review. The company had struggled after experiencing a pandemic boom due to its partnerships with makers of Covid-19 vaccines. Catalent’s stock has declined in the months since the settlement was announced.

BioMarin

Shares of BioMarin Pharmaceutical Inc. surged 12%, its best one-day performance since 2015, on a Nov. 7 report that Elliott had built up a stake in the company.

Shares of Pinterest surged 16% when Elliott Management’s stake in the social media company was reported in July 2022. The following December, Pinterest added a board seat for the investor. The stock is up almost 30% year to date.

Cubic

Cubic Corp. shares jumped more than 30% when it said that Elliott Management — which had taken a stake — and a private equity partner were interested in purchasing the company in September 2020. Elliott and Veritas Capital offered to buy Cubic for $71 per share, or an equity value of $2.21 billion the following February. Ultimately, Elliott’s bid was topped by Singapore Technologies Engineering Ltd. who offered $2.41 billion to purchase the company in March 2021.

Public Storage

Elliott had built a stake in Public Storage and nominated six directors to its board in December 2020. In January 2021, the company added two new board members and established an advisory committee focused on its long-term strategy and growth. Elliott exited most of its stake in the company, per a February 2022 filing.