The European Central Bank won’t wait as long as previously forecast to cut its interest rate, with the first reduction now anticipated in the second quarter, Goldman Sachs economists said.

The US investment bank changed its prediction in a report on Thursday, hours after data showed that inflation in the region weakened markedly toward the 2% goal targeted by policymakers. Economists including Jari Stehn previously expected a move in the third quarter.

“While we see a significant hurdle for rate cuts before Q2, the risks around our baseline are clearly skewed towards a faster cutting cycle if inflation continues to slow more quickly than expected or if growth fails to improve next year,” the analysts wrote.

The change aligns their view more to that of investors, who have now fully priced in a reduction in April despite the insistence by many ECB officials that borrowing costs should stay high for a while.

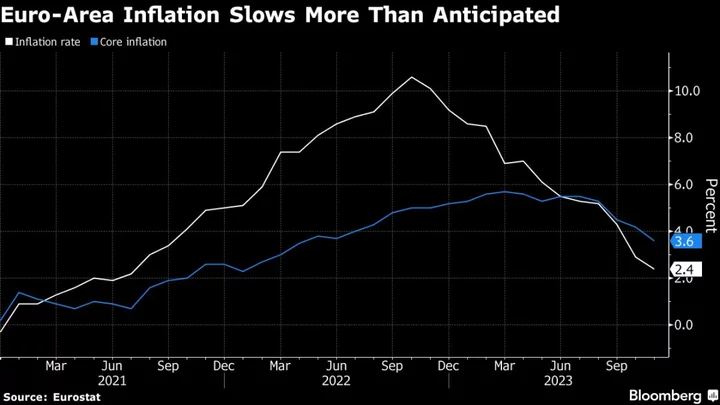

The data on Thursday were the most marked piece of evidence so far that the backdrop for prices is rapidly turning. Inflation came in at 2.4% in November, less than half its pace as recently as August, and the third outcome in a row that was lower than economists anticipated.

Aside from the price data, the Goldman economists also based their new forecast on a bigger fiscal drag in Germany hurting the euro-zone economy, and evidence that the labor market is slowing.

“That said, we still look for a gradual cutting cycle,” they wrote, observing that the region’s growth should still improve next year, and measures of wage increases are still “firm.”

While the ECB’s upcoming meeting on Dec. 14 will feature new forecasts that could lay the groundwork for a shift in view, hawkish officials don’t seem ready for that. Bundesbank President Joachim Nagel insisted on Thursday, after the release of the data, that inflation risks are “skewed to the upside.”

By contrast, Bank of Italy Governor Fabio Panetta, a longstanding dove on the Governing Council, warned his colleagues not to keep rates high for too long.

“Disinflation is well under way,” he said on Thursday. “We need to avoid unnecessary damage to economic activity and risks to financial stability, which would ultimately jeopardize price stability.”