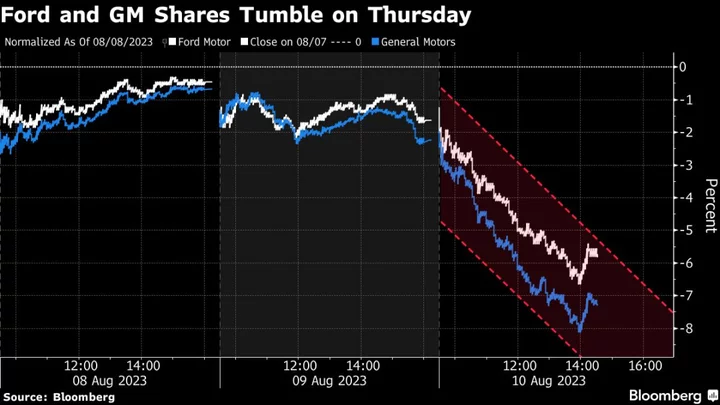

General Motors Co. and Ford Motor Co. were among the biggest decliners in the US stock market Thursday on growing concern that demands from union leaders could send the automakers’ labor costs soaring.

The United Auto Workers are calling for wage increases and other changes that the biggest US car companies estimate would add more than $80 billion in expenses for each of them, Bloomberg reported this week. The demands come just weeks after the Teamsters union reached a tentative deal with United Parcel Service Inc. adding tens of billions of dollars in new costs, which led the courier to cut its financial outlook for the year.

GM shares fell 5.8% Thursday in New York, their biggest daily plunge in nearly eight months. Ford fell 4.5% and Stellantis NV declined 1.8%. GM and Ford were the second- and fourth-biggest percentage decliners on the benchmark S&P 500.

“GM and Ford may be in the penalty box for a while. Wall Street hates uncertainty,” said Morningstar analyst David Whiston. “This is not a normal negotiation both in style and the demands they are asking.”

The so-called Big Three US automakers are mired in tense negotiations with the UAW on a new four-year contract. The union wants a 46% wage increase, restoration of traditional pensions, cost-of-living increases, a shorter work week and better retiree benefits.

Read More: UAW Demands Would Add $80 Billion to US Carmaker Labor Costs

The carmakers have pushed back on many of the demands, but organized labor is having a moment in the US, especially after Teamsters’ success negotiating the favorable new deal last month with UPS.

UAW President Shawn Fain contends the roughly 150,000 union-represented workers at GM, Ford and Stellantis are due a payback for helping the companies recover from the Great Recession a decade ago, which set them up for record profits. On the other hand, the carmakers say they already offer generous pay and benefits, and need to keep wages competitive with lower-paying and non-union rivals like Tesla Inc. as they invest billions into the shift to electric vehicles.

“The ongoing talks with the UAW over a labor agreement always cause concerns for investors because a potential strike would negatively impact operations at the companies, and impact profit outlooks,” Argus Research analyst William Selesky said in an interview.

--With assistance from Catherine Larkin and David Welch.

(Updates with closing stock moves in third paragraph.)