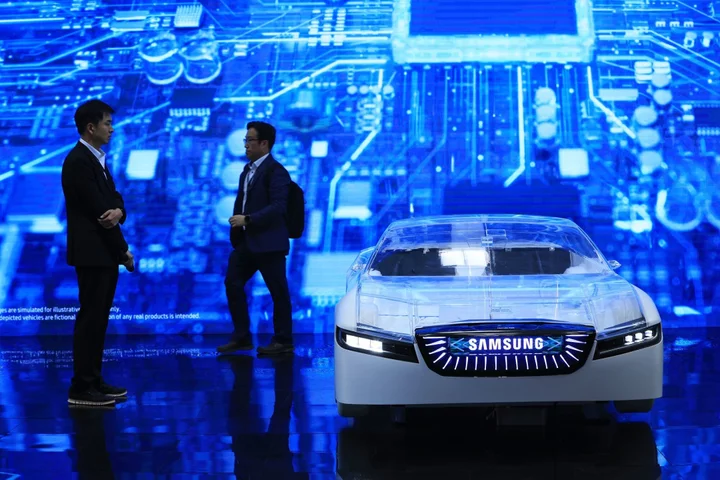

Schmid Group, a German provider of advanced electronics manufacturing techniques, is nearing an agreement to go public in New York through a deal with automotive veteran Ralf Speth’s blank-check company, people with knowledge of the matter said.

The family-owned firm’s potential merger with Pegasus Digital Mobility Acquisition Corp. could be announced as soon as Wednesday, the people said, asking not to be identified because the information is private. The deal is set to give Schmid a valuation of about $640 million including debt, according to the people.

Schmid, which started as an iron foundry in 1864, is based in Freudenstadt, a town in the heart of the Black Forest known for its fresh air and lush trails. It has developed equipment and manufacturing processes for printed circuit boards, as well as technology used to handle advanced materials for industries including renewable power and energy storage.

The company has more than 800 employees. Its deal with Pegasus Digital shows how special purpose acquisition companies have shifted their focus toward growing, profitable targets after a record surge of SPAC listings in 2020 and 2021 helped drive deals with often wobbly startups.

Pegasus Digital raised $200 million in its October 2021 initial public offering, saying when it listed that it would search for a deal in sectors including next-generation transportation. The SPAC is backed by StratCap, an investment firm focused on digital infrastructure. Speth, who serves as chief executive officer of the SPAC, spent more than 20 years at BMW AG and later ran Jaguar Land Rover after its sale to India’s Tata Motors Ltd.

Former Morgan Stanley investment banker F. Jeremey Mistry is the SPAC’s chief financial officer, while ex-Jaguar Land Rover executive Stefan Berger is chief investment officer.

Author: Eyk Henning, Aaron Kirchfeld and Liana Baker