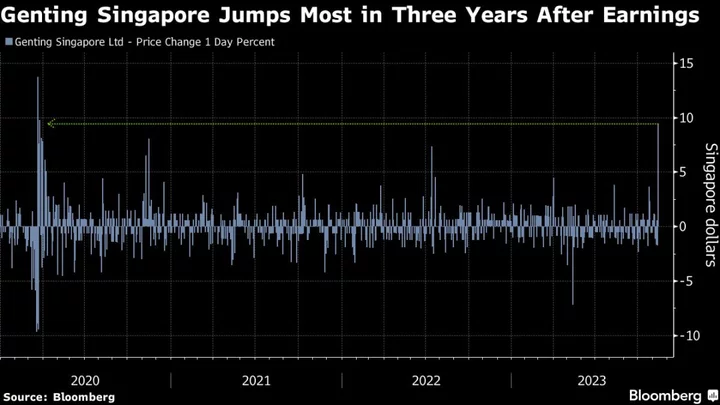

Genting Singapore Ltd. jumped the most in more than three years after the casino operator posted better-than-expected third-quarter earnings, underscoring a recovery in tourism in Singapore.

The shares climbed as much as 12%, their biggest gain since March 2020, and putting them among the best performers on the MSCI Asia Pacific Index. The advance helped narrow the stock’s year-to-date loss to just 2.6%.

Genting Singapore’s quarterly sales increased 33% from a year earlier, while net income surged 59%, the company said in an exchange filing late Friday. The board also approved total investment of around $6.8 billion over the next eight years.

One of just two casino operators in the city-state, Genting Singapore operates Resorts World Sentosa, a 49-hectare (490,000 square-meter) venue on an island off Singapore’s southern coast. Earnings have continued to recover from the Covid era with a revival in regional travel and gaming demand.

The company reported “a clean earnings beat, after a long time, where Ebitda finally exceeded pre-Covid levels as Genting re-gained share from rival” Marina Bay Sands, JPMorgan Chase & Co. analysts including DS Kim wrote in a note, upgrading Genting Singapore’s stock to overweight from neutral.

The risk of investors incurring losses is limited by the stock’s valuation, and they “can start accumulating the name for steady returns with a long-term optionality.” the analysts wrote. The brokerage’s price target of S$1.1 implies a potential 29% gain from Friday’s close. Singapore markets were closed for a holiday on Monday.

“We believe RWS is one of the major beneficiaries from the return of inbound visitors,” Citigroup Inc. analysts including George Choi wrote in a note, while lowering their price target to S$1.2 from S$1.26 to reflect the higher capital spending. “A likely increase in dividends is another reason for investors to buy this stock, in our view.”