Ferrari NV and Cie de Saint-Gobain SA will join the euro area’s main stock benchmark as of Sept. 18, according to a statement from Stoxx Ltd.

The luxury car maker and the French glass manufacturer will replace German real estate company Vonovia and building materials company CRH in the Euro Stoxx 50 benchmark, the index provider said late Friday.

Ferrari’s ascent to a listing among the euro area’s most valuable companies is the latest chapter in the iconic car brand’s successful turn as a publicly traded company.

Ferrari shares have jumped seven fold since their debut in 2015, and the supercar-maker’s addition to the Euro Stoxx 50 will place it in Europe’s most liquid index. LVMH and Hermes are some of the top members as well as premium car makers BMW AG and Mercedes-Benz Group AG.

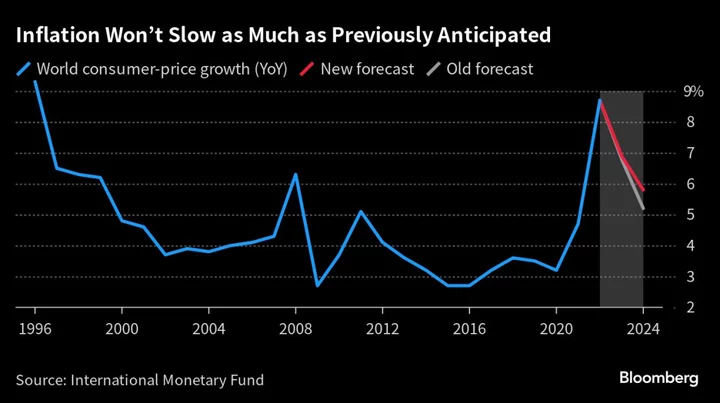

Ferrari’s clean track record took a hit in August after a disappointing forecast. Before that Ferrari had been able to raise its prices for a clientele that is less impacted by soaring inflation and rising interest rates.

Saint Gobain is a maker of glass products used in construction. Its shares have rallied 32% this year.

The exit of Vonovia strips the index of its last real estate firm as the sector grapples with the aftermath of a shift in work habits and the squeeze from rising interest rates on asset values and refinancing costs.

Inclusion in widely followed indexes is becoming more important for companies in a world increasingly dominated by passive investment funds.

Author: Jan-Patrick Barnert