Federal Reserve Bank of St. Louis President James Bullard, an influential voice who called for aggressive interest-rate hikes to fight the recent inflation surge, resigned after 15 years in the position to become dean of a university business school.

Bullard, 62, stepped down from his post as head of the bank effective Thursday. He will fully depart Aug. 14 to become the inaugural dean of the Mitchell E. Daniels, Jr. School of Business at Purdue University, the St. Louis Fed said in a statement Thursday.

Bullard has been pushing the Fed since mid-2021 to take more-aggressive steps to curb the fastest inflation in decades. He argued that the Fed was wrong to consider price pressures “transitory” and was among the first to call for jumbo-sized hikes, including three-quarter point moves.

Read More: Bullard Becomes Wall Street’s Go-To Guy for Hint of a Fed Pivot

Bullard, who doesn’t vote on rate decisions this year, has been seen as a bellwether because his views have sometimes foreshadowed policy changes. He published a paper in 2010 titled “Seven Faces of the Peril,” which called on the central bank to avert deflation by purchasing Treasury notes. That was followed by a second round of bond buying.

While Bullard remains at the bank in an advisory capacity over the next month, he has recused himself from his monetary policy role on the Federal Open Market Committee and other related duties and has ceased all public speaking, the St. Louis Fed said.

“Bullard was an intellectual force on the FOMC, at once dovish but recently on the hawkish end with strong theoretical appeals for getting ahead of the inflation issue,” said Derek Tang, economist with LH Meyer/Monetary Policy Analytics. “His absence will lessen the discourse power of the hawks and put more weight on similarly vocal but dovish peers” like Chicago Fed President Austan Goolsbee.

The St. Louis Fed’s No. 2 official, Kathleen O’Neill Paese, becomes interim president effective immediately. The bank’s board will begin a search that’s “robust, transparent, fair and inclusive,” according to the statement.

Rate Expectations

Bullard’s departure will have “just a very small impact” on the rate path in 2023, “marginally making a second hike less likely,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co.

“As a non-voting member he still gets to express his opinion and could influence others modestly,” she said.

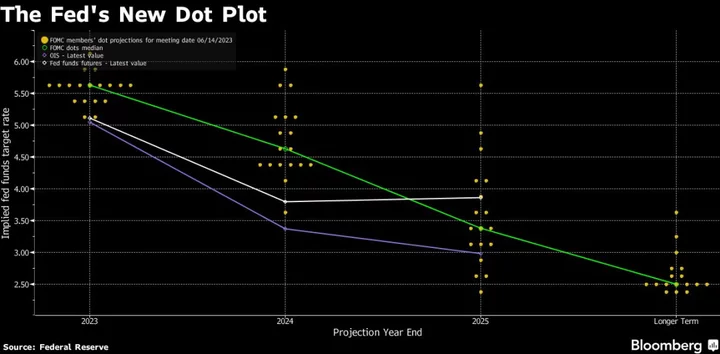

Fed officials are expected to raise their benchmark lending rate by a quarter-point at their July 25-26 meeting, after holding rates steady last month in a range of 5% to 5.25%. Policymakers have penciled in two more rate hikes this year, according to their median forecast released after the June gathering.

Tang said he doesn’t expect the vacancy to change the outlook, given Powell’s commitment to keeping upward pressure on rates until officials are sure inflation is contained.

In addition, the St. Louis Fed board tends to be among the more hawkish in the Fed system — it was one of four bank boards that recently sought a quarter-point increase in the discount rate — and its interim leader is likely to support further tightening, he added.

Bullard, speaking before the Fed’s last policy meeting, said he expected policymakers would have to raise rates two more times this year to curb price pressures.

“I think we’re going to have to grind higher with the policy rate in order to put enough downward pressure on inflation and to return inflation to target in a timely manner,” he said at a May 22 event in Fort Lauderdale, Florida.

Another Vacancy

Bullard’s departure will leave a third vacancy on the Fed’s 19-member rate-setting committee. Economist Adriana Kugler is awaiting confirmation as governor on the Fed board, and the Kansas City Fed is still searching for a permanent leader to succeed Esther George, who retired as the bank’s president in January.

Bullard, who was the longest tenured among the current regional Fed presidents, had given no hint that he was considering an early departure from the bank. He didn’t face mandatory retirement at 65 for several years.

David Andolfatto, an economist who left the bank last year to head the University of Miami’s economics department and has continued to visit the bank, said the move came as a “shock.”

Andolfatto said Bullard’s academic background made him appreciate the role of theory in interpreting data and developing policy recommendations.

“He did not dissent often, but when he did he was always proved right,” he said. “He was always ahead of the curve.”

Bullard cast four dissenting votes during his tenure on the FOMC: once in March of 2022, favoring a larger interest-rate increase, and three times before the pandemic in favor of easier policy.

A native of Forest Lake, Minnesota, Bullard went to study economics at St. Cloud State University and earned his doctorate at Indiana University.

Bullard was selected for his new position at the conclusion of an eight-month international search, with the goal of building “a premier business school in the country for a tech-driven free-market economy,” Purdue President Mung Chiang said in an interview.

“I was blown away by both his leadership track record and by how deeply and innovatively he thinks as a scholar,” he said.

--With assistance from Jonnelle Marte and Catarina Saraiva.

(Updates with comment from Purdue president in 22nd paragraph.)