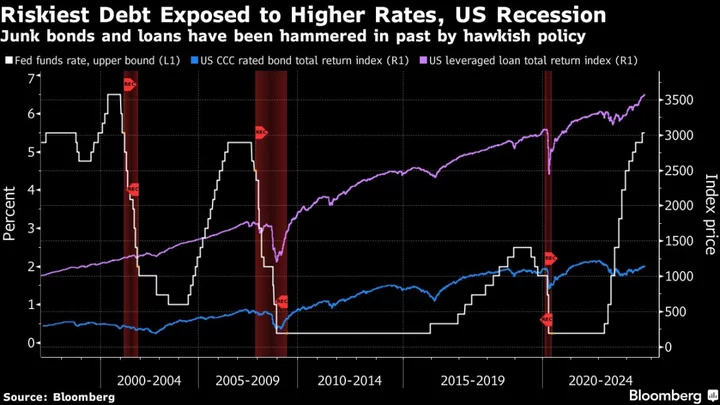

Two Federal Reserve officials made the case for continuing to hold interest rates steady on Wednesday, while a third warned that the risk of stubborn inflation should keep the option to hike further on the table.

Cleveland Fed President Loretta Mester, who’s been among the officials calling for higher rates this year, said policy is well positioned for the central bank to be nimble and respond appropriately to the evolving outlook, suggesting she would support another rate pause at the Fed’s rate-setting meeting next month.

“Monetary policy is in a good place for policymakers to assess incoming information on the economy and financial conditions and judge whether policy is well calibrated to ensure that inflation is on a timely path back to 2%,” Mester said Wednesday at an event in Chicago.

Atlanta Fed President Raphael Bostic, who was among the earliest policymakers to suggest rates had reached their peak, said he’s growing increasingly confident that inflation is firmly on a downward path. Richmond Fed chief Thomas Barkin, who said he isn’t yet convinced, argued the central bank should keep the option to hike interest rates on the table in case inflation proves stubborn, but he stopped short of endorsing a hike next month.

“If inflation comes down naturally and smoothly, awesome,” Barkin said at the CNBC CFO Council Summit Wednesday. “But if inflation is going to flare back up, I think you want to have the option of doing more on rates.”

All three presidents will be voters on the Fed’s policy-setting committee next year, a time when traders are increasingly betting that the central bank will start cutting interest rates. Billionaire investor Bill Ackman made waves earlier this morning when he said he’s betting the Fed will begin trimming rates even sooner than markets are predicting.

Officials are widely expected to leave the benchmark interest rate at a 22-year high when they gather Dec. 12-13. Policymakers will update their interest-rate and economic projections at that meeting, which will provide further insight into the potential path of policy next year.

Mester didn’t explicitly say that she’d support a third straight pause in rate increases next month, but her remarks echo those made by other hawkish policymakers this week. She is due to step down as president of the Cleveland Fed in June, when her tenure ends.

Read More: Fed’s Mester Says Policy in ‘Good Place’ to Assess Incoming Data

Governor Christopher Waller on Tuesday said he’s increasingly confident that the policy rate is well positioned to bring down price growth to the Fed’s goal. Governor Michelle Bowman said she remains willing to support rate hikes if inflation progress stalls, but didn’t suggest an increase was needed next month.

Inflation Outlook

Bostic and Barkin pointed to a mix of economic figures and anecdotal data to support their views, though the two arrived at different takeaways on the outlook for inflation.

“I’m sensing greater clarity about a few important currents,” Bostic wrote in the essay released Wednesday. “Our research and input from business leaders tell me the downward trajectory of inflation will likely continue.”

The Fed’s Beige Book survey of regional business contacts — published Wednesday and containing information gathered on or before Nov. 17 — showed US economic activity slowed in recent weeks as consumers pulled back on discretionary spending.

Central bank officials are increasingly relying on this type of information to assess the path of the economy and inflation.

Read More: Fed’s Bostic Says Evidence Points to Downward Path for Inflation

Mester also pointed to cooling price pressures, adding that “there has been discernible progress on inflation even while the overall economy has remained relatively strong.”

Barkin, meanwhile, pointed to lingering price pressures in housing and the service sector as reasons to be cautious. The sentiment of the comments were similar to those he made last week.

Bostic did not specifically address the path of interest rates in the essay, but he has previously said he doesn’t believe more hikes are needed. He was also ahead of his colleagues in calling for an end to increases.

(Updates with Mester comments in second paragraph.)