Vietnam’s sluggish economy is hitting many where it hurts the most: their thirst for beer.

Tipplers in this beer-swilling country are cutting back on their one affordable luxury — and often it’s because households are prioritizing their budgets for daily essentials as they brace for more economic headwinds.

“I’ve told my husband to cut back on drinking beer,” said Pham Thuy Trang, a 48 year-old hairdresser in Ho Chi Minh City, as she saves money for essentials such as food, healthcare and electricity. “Living costs are increasing these days so we have to seriously trim down on the unnecessary stuff.”

While inflation is still relatively low at less than 3%, it’s the slack in the economy that’s worrying most Vietnamese and pushing them toward austerity. The Southeast Asian manufacturing powerhouse has seen exports drop for six straight months — the longest spell since 2009 — amid softer global demand for goods and China’s wobbly recovery.

The next pulse-check for the economy is due Friday, with economists surveyed by Bloomberg expecting data to show 5% growth in the quarter ending September, from 4.14% in the previous three months. While that’ll be the second straight quarter of acceleration, it’s still not enough to propel full-year performance to the government’s 6.5% goal this year.

The International Monetary Fund expects 2023 growth to slow to 4.7%, with a statement from the lender’s executive board Wednesday underlining the need for fiscal policy to take the lead in supporting economic activity, given the limited room for monetary policy.

In the backdrop of still fragile demand, companies have been reluctant to take on extra staff, leading to a marginal fall in employment in August, according to S&P Global Market Intelligence. That explains why the nation’s many ‘quans’ — where Vietnamese people like to gather after work to drink — are seeing sales slow.

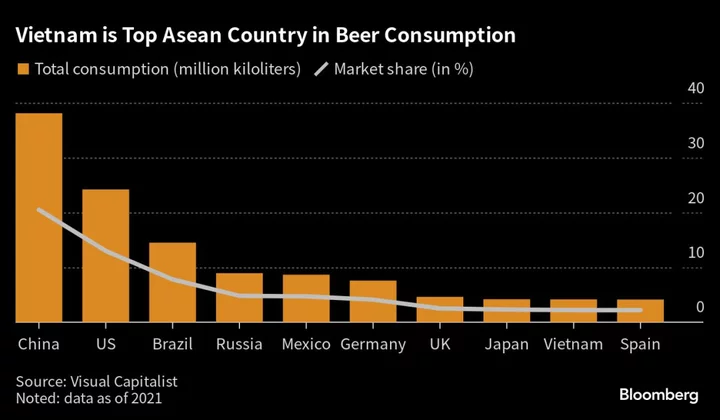

Vietnam ranks No. 1 in Southeast Asia in beer consumption and ninth globally. So budget cuts by households are rippling across the country’s beer-producing sector and overseas, where brewers have long looked to Vietnam for growth.

Vietnam and Nigeria accounted for more than half of the drop in Heineken NV’s drop in consumption during the first half of the year, the company said July 31.

Amsterdam-based Heineken, the largest premium brewer in Vietnam, cut its earnings forecast. “We ran into a pretty strong economic slowdown in the key market of Vietnam, which is disproportionately important to us,” Chief Executive Officer Dolf van den Brink said in an interview with Bloomberg News earlier. The Dutch brewer plans to add $500 million to the $1 billion it already invested in the Southeast Asian nation, where it operates six factories.

Analysts expect earnings growth to slow at Thai Beverage Pcl, the parent of Vietnam’s largest brewer Saigon Beer Alcohol Beverage Corp. While Sabeco’s revenue dropped 11% in the fiscal first-half, Bloomberg Intelligence’s Senior Industry Analyst Lisa Lee sees sales growth remaining tardy in the remainder of the year and through 2024.

Hai Phong JSC, or Habeco, the country’s second-biggest beer company partly held by Carlsberg AS, saw second-quarter revenue drop 2.6% year-on-year and profit after tax decline 8% from a year ago.

‘Very Challenging’

“Vietnam’s beverage industry is in a very challenging period now,” Nguyen Van Viet, chairman of Vietnam Beer Alcohol Beverage Association, said by telephone from Hanoi Wednesday. Citing a 10%-20% drop in beer sales and an as much as 50% increase in cost of materials, he said the association has asked the government to delay a special consumption tax hike on the beverage.

Although a mug of beer can be had for as cheap as 11,000 dong (45 cents) in Vietnam, people are still looking at ways to pare expenses.

“I used to go out for beer with my buddies about 10 times a month, but now it’s down to four or five times,” said Do Tan Thanh, a 41-year-old grab-taxi driver in Ho Chi Minh City. “My wife still wants me to switch to buying beers from stores and take it home with friends to save money.”

(Corrects 2Q GDP number in the fifth paragraph.)