Natural gas prices in Europe slumped as unusually warm weather destroys demand already eroded by weak industrial consumption.

The contract for November delivery declined as much as 7.5%, touching the lowest level since it started trading in late 2017. It has dropped more than 15% within the past week. Day-ahead prices also plunged.

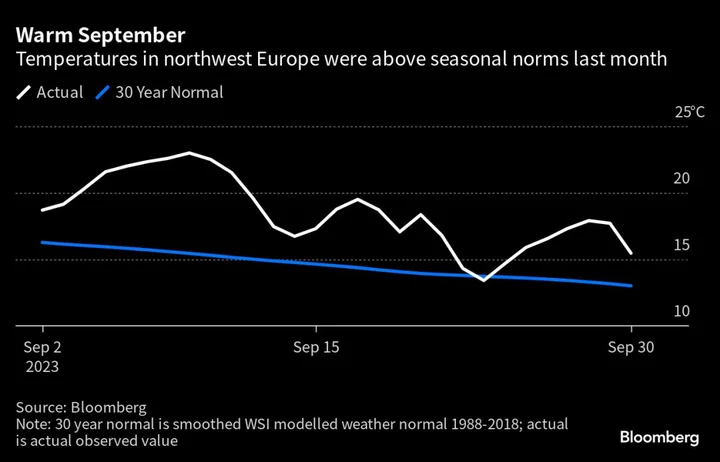

Temperatures are forecast to rise above 20C (68F) from London to Frankfurt to Paris by the weekend, and will stay above normal through at least the middle of the month, according to Maxar Technologies. That will delay the start of the heating season, following a warm September.

Storage sites keep adding the fuel, with inventories in the region around 96% full on average, according to data from Gas Infrastructure Europe. Separately, Egypt plans to resume exports of liquefied natural gas this month, adding to global supplies.

The lack of demand is keeping prices in check, even as traders continue to monitor the market for supply risks, such as recent prolonged outages in top-supplier Norway.

Gas consumption in the European Union and the UK in September was 9% lower than a year ago, Tom Marzec-Manser, head of gas analytics at ICIS, said in a post on social media platform X, confirmed by email. It was also 20% lower than the average in 2017-2021 for the month, not adjusted for temperatures, according to early data from ICIS.

In Germany, commercial and residential demand last month was almost a half what it was a year ago, he said, adding that the small amount of industrial demand growth from August has “totally evaporated.”

Dutch front-month gas, Europe’s benchmark, declined 7% to €36.60 a megawatt-hour by 12 p.m. in Amsterdam. Day-ahead prices in the Netherlands and the UK also slumped, with prompt prices in Britain hitting the lowest levels since early August amid elevated wind generation.

--With assistance from Elena Mazneva.