European government bonds rallied while the euro and risk-sensitive Nordic currencies sank as cooling inflation prints and weak Chinese data spurred wagers the rate-hike cycle is nearing its end.

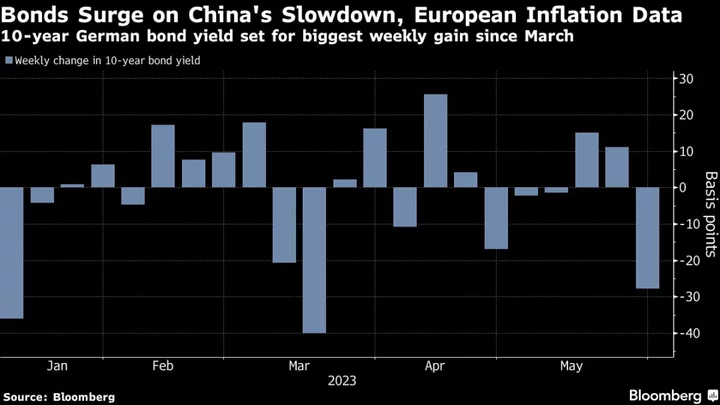

The yield on Germany’s 10-year benchmark note headed for its biggest weekly decline in more than two months as government bonds across the region climbed after slower-than-anticipated inflation readings for France and Germany. Money markets pared bets on additional rate hikes by the European Central Bank.

Europe’s industrial slump and China’s stumbling emergence from Covid Zero policies are driving the disinflationary trend as the world economy flirts with recession. Worsening Chinese factory data on Wednesday pushed investors to the safety of the dollar, leaving the euro lower and the Swedish krona on track for its worst month in more than 10 years.

“The writing looks to be on the wall in terms of global growth,” said Richard McGuire, rates strategist at Rabobank. “There’s a lot of tightening still making its way though the system, which argues that we’re likely to see the impact of policy on demand increasing in the coming months.”

Traders are no longer pricing a full 50 basis points of cumulative rate increases by the ECB, with markets pointing to the key rate peaking just below 3.75% by September. The deposit rate is currently 3.25%.

“Excluding an upside surprise in core inflation, we can avoid the 4.0% terminal rate scenario with a last rate hike in September,” said Theophile Legrand, a rates strategist at Natixis.

French Inflation Slows More Than Expected to Weakest in Year

European government bonds will likely trade somewhere between their highs and lows of the past month in the near-term, implying a yield range of about 2.20% to 2.50% for 10-year bunds, according to Evelyne Gomez-Liechti, a rates strategist at Mizuho International Plc.

Since Friday’s close, the yield on the German benchmark bond has tumbled about 30 basis points to 2.25%.

What Bloomberg’s Strategists Say...

Weakness in Chinese manufacturing data was another signal that recovery in the world’s second-largest economy has lost traction. Combine that with money market pricing on the Fed, and case for another dollar rally gets stronger.

— Vassilis Karamanis, FX and rates strategist. For the full note, click here

The euro sank to 1.0659 against the dollar on Wednesday, its weakest since March, putting the pair on track for its worst monthly performance since April 2022.

“The market is already comfortably priced for further rate hikes and moderating price data and the threat that the eurozone is facing stagnation in the second half suggest that the euro can sink further versus the dollar in the coming weeks,” said Jane Foley, head of FX strategy at Rabobank.

Positioning can also help explain the move lower. Traders are keen to build long dollar positions at a time when investors are likely having second thoughts about the recent build-up of euro longs, Foley added.

While the growth concerns provide a tailwind for bonds, they weigh heavily on riskier currencies. Expectations are increasing that Sweden and Norway will stop raising rates before the ECB, leaving their interest-rate differentials versus other European economies even more unattractive to carry traders.

The krona has tumbled more than 6% versus the dollar this month, its biggest fall since 2012, while the Norwegian krone is on track to lose around 5% — its worst month since September.

“The risk-off wave coming from China puts European currencies in a vulnerable position and the Swedish krona remains the favorite short in the region given the Riksbank’s unsupportive narrative and other domestic issues,” ING strategists including Chris Turner wrote in a note Wednesday.

(Updates with German CPI in paragraph two, additional strategist comment in paragraphs 10 and 11.)