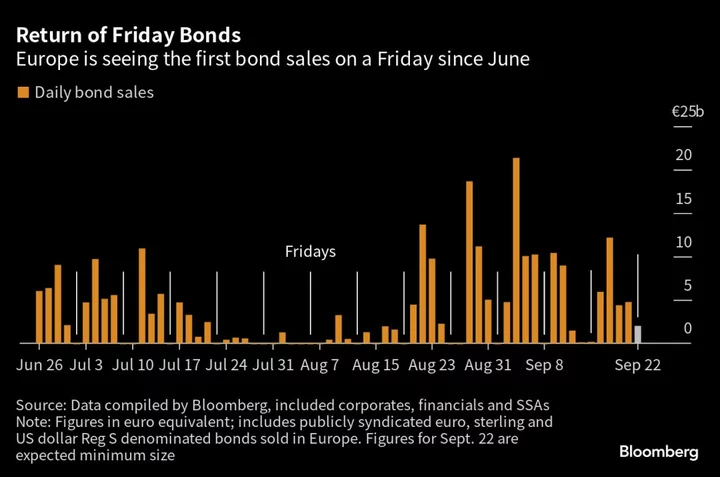

The bond market in Europe is open for business on a Friday for the first time since June.

Royal Bank of Canada and Deutsche Boerse AG are selling bonds in the first deals on a Friday in 13 weeks, according to data compiled by Bloomberg. Last week, a €165 million offering from Azerion Group NV officially priced on Friday having already closed books and set pricing on Thursday.

While Fridays have always seen a slower pace of issuance compared to earlier in the week, the past three months has seen no activity with bankers and investors opting to use the end of the week to prepare for the week ahead.

Read more: In Europe’s Bond Market, Fridays Are for Preparing, Not Selling

German stock exchange operator Deutsche Boerse held investor meetings Thursday for the offering, and people familiar with the deal said the marketing received good feedback so the company opted to do the deal before the weekend.

A spokesperson for Deutsche Boerse declined to comment. A spokesperson for RBC confirmed the bank was in the market with the deal and declined to comment further.

This week has already seen more than €27 billion of issuance from corporate, financial and public-sector borrowers, with Friday’s deals set to add a minimum of €2 billion to that total, the data show.

(Updates with response from spokespeople in the fifth paragraph.)