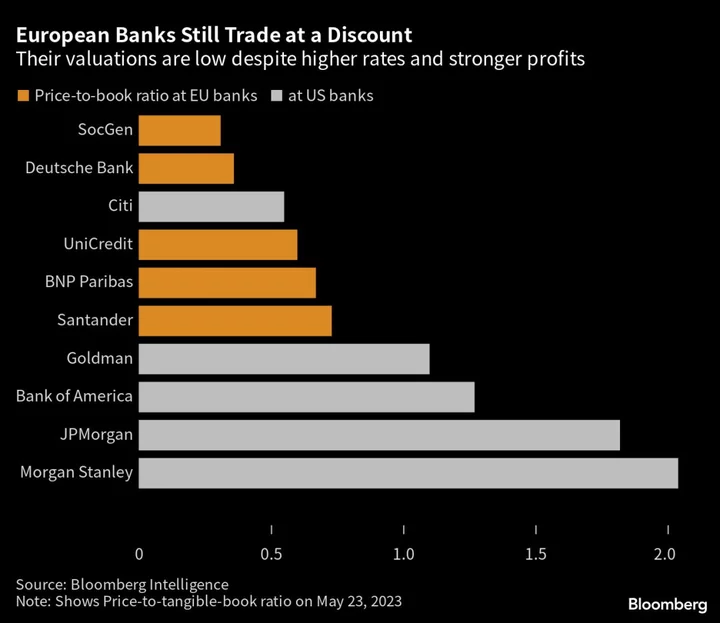

PacWest Bancorp lost $1 billion in one quarter, saw its stock drop 89% in two months, and has been selling assets to shore up confidence. Deutsche Bank AG just had its most profitable 12 months since 2007.

PacWest’s stock still trades at the higher premium of the two.

The valuation gap at the German lender — which just had its most profitable 12 months since 2007 — typifies the challenge facing many major European banks. While they’ve largely dodged the issues sending US bank shareholders rushing to the exits, investors still aren’t buying.

“We are dissatisfied with our share price,” Deutsche Bank Chief Executive Officer Christian Sewing said at the firm’s annual general meeting in Frankfurt last week, vowing to “do more to convince the market of our merits.”

The frustration is echoed by bank leaders across the region, who are struggling to win back investors even as they reap the benefits of rising interest rates and a global trading boom. Frederic Oudea, who stepped down as Societe Generale SA CEO this week after 15 years, lamented that the share price of the French firm is substantially lower now than when he took over.

For Sewing, its a similar situation. He took the top job just over five years ago, when Deutsche Bank was in a severe crisis of confidence. He’s cut thousands of jobs, refocused on the bank’s historical strengths and restored profitability and revenue growth. Yet the stock still trades about 15% below where it was when he assumed the role.

That values Germany’s largest bank at about a third of the tangible equity in its books. PacWest, despite its troubles, trades at around 40%.

The picture is similar at other European banks. Many have undergone painful reorganizations in recent years. They’ve also largely avoided contagion from the US banking crisis, with higher capital buffers than ever, and are emerging well from early rounds of this year’s stress tests. Yet their shares continue to trade at discounts to their book value, while many of their large US peers trade at a premium.

Some investor hesitation can be explained by a traditional wariness built up over the past decade or so. Europe’s banking industry is notoriously fragmented compared with the huge US market, posing a structural obstacle to higher profits.

Years of negative interest rates that severely depressed profitability, strict regulations, curbs on shareholder payouts during the pandemic and expensive restructurings are also fresh in the memory. Many US banks have done significant buyback plans and dividend hikes, with EU peers now starting to catch up. Some European bank investors are still nursing severe losses on bets that turned out to be too early.

At Credit Suisse Group AG, shareholders were hit badly in the rescue late March, and investors in its hybrid debt were wiped out completely. The government-orchestrated deal has made large Middle Eastern investors wary of bank stocks, after some had put large sums of money into Credit Suisse just months earlier.

Deutsche Bank saw two top institutional shareholders exit last year when Cerberus Capital Management and Capital Group cut their stakes. And despite its turnaround, the lender remains vulnerable to bouts of investor nervousness.

The shares slumped as much as 15% on March 24, when Credit Suisse’s near-collapse reverberated across markets, rekindling fears that Sewing and his lieutenants had long sought to end for good. Regulators later singled out a trade on its credit default swaps they suspect fueled the sell off.

“I hope that what some call ‘muscle memory’ will fade in the market,” Chief Financial Officer James von Moltke said last month when asked about the event.

Analysts now almost unanimously see European banks as an opportunity. The five biggest EU bank stocks have 93 buy recommendations, compared with just 6 sell suggestions, according to data compiled by Bloomberg. But persuading investors may take longer.

“In the end, I leave with only one frustration, the stock price and failing to get the buy-in of the market,” Oudea said in an interview with French newspaper Le Monde during his final week in office.