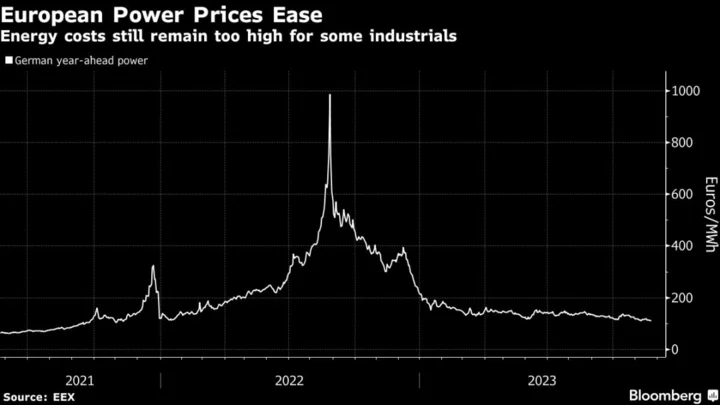

Benchmark electricity prices in Europe have fallen to levels last seen two years ago in a positive sign for its economy as France manages to get its crucial nuclear reactors back online.

Extensive repairs have eased supply-crunch concerns around France’s vast fleet of nuclear reactors, which make up about two-thirds of the country’s power output. Electricite de France SA, the state-owned utility, forecasts as much as 330 terawatt-hours this year, an 18% increase on 2022.

That’s set to provide a stronger buffer for the continent’s power system, which is also helped by a more plentiful supply of liquefied natural gas — a stable source of fuel for many of Europe’s power stations. French nuclear availability is “rapidly improving,” analysts at Engie SA’s EnergyScan wrote Wednesday.

The sustained fall in power prices provides relief to Europe’s ailing industrial sector, which has sounded dire warnings amid unbearably high costs of production. Soaring electricity bills have pushed businesses and households to reduce their energy consumption, especially as inflation bites across the economy.

Power for delivery in Germany next year fell to €110.18 ($120.15) per megawatt-hour on Tuesday, its lowest close since November 2021. The French equivalent also reached similar lows — though both remain about double the cost before supply imbalances drove prices higher earlier that year.

Lower demand for power and a rise in renewable output has also helped bring down Europe’s carbon price, essentially a tax on power produced from fossil fuels. Carbon permits for December are trading just below €76 per ton, near the lows of last November.

Energy costs still haven’t fallen as sharply as many energy-intensive sectors had hoped. In a report last month, the European Chemical Industry Council said the sector hasn’t seen a recovery materialize and that demand for chemicals is still on the decline.

Corporate power-purchase agreements, where large consumers secure supplies from utilities, are also seeing prices drop, but are still a “far cry” from lows before the crisis, BloombergNEF’s Helen Dewhurst wrote in a note Tuesday. Buyers “must adjust to the new reality of high prices,” she wrote.