European natural gas prices slumped as traders weighed mild weather forecasts and rising fuel supplies against the possible escalation of the conflict in the Middle East even as Israel held off on its ground offensive into Gaza.

Benchmark futures fell as much as 6.4% on Monday, extending last week’s decline. Still, futures are almost 30% higher than where they were before the Oct. 7 attack on Israel by Hamas and traders are watching every headline on how the situation in the region develops.

Israel Latest: Western Leaders Link Efforts to Stop War’s Spread

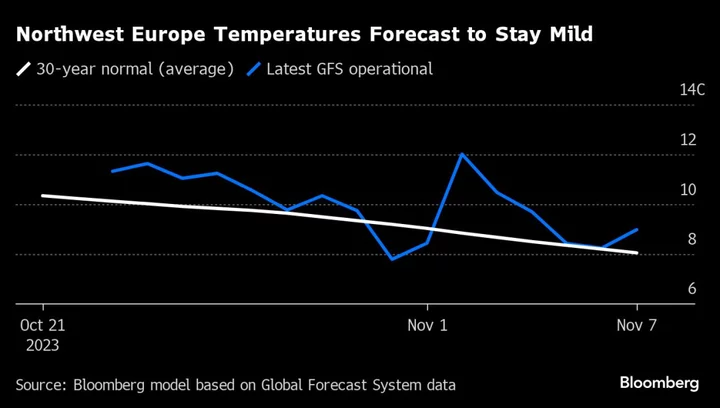

Israel continued with airstrikes on Gaza but appeared to delay a ground invasion as diplomatic efforts continue to free more hostages. The moves to contain any escalation of the conflict is providing some short-term relief to markets just as most of Europe will be milder than average into early November, according to a daily note from Maxar Technologies Inc. Nearly full inventories are also providing some stability, while demand remains below normal after last year’s energy crisis forced companies and households to cut usage.

“Gas has settled into a range of around €50 with ample supply and mild weather offsetting Middle East related supply risks,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S. “Energy prices are generally lower as Israel holds off invasion, but its very difficult to price a not-yet-realized disruption.”

Traders are also following a recent wave of new long-term liquefied natural gas supply deals that reflect a growing recognition that the fuel will be required for longer than previously anticipated to complement adoption of renewable energy. Italy’s Eni SpA signed a 27-year LNG agreement for deliveries from a project in Qatar, following a similar deal last week from Shell Plc to buy Qatari liquefied natural gas for the Netherlands.

Read More: Gas Deals Beyond 2050 Show Reality Gap on Europe Climate Goals

Dutch front-month futures, Europe’s gas benchmark, fell 4.00% to €49.06 a megawatt-hour at 10:30 a.m. in Amsterdam.