Euro-zone inflation cooled more than expected, putting the 2% target in sight as investors step up bets that the European Central Bank will cut interest rates sooner than officials suggest.

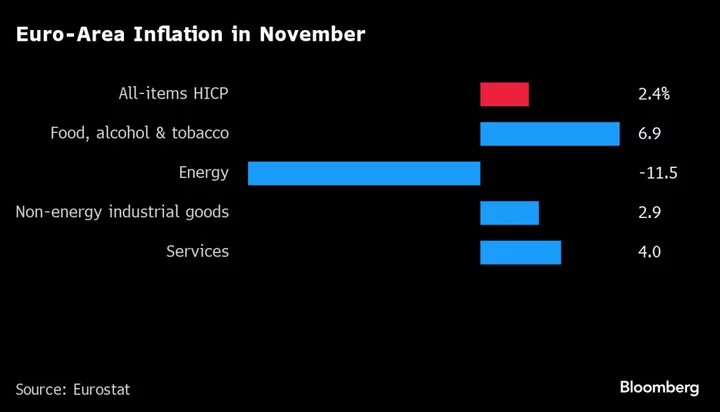

Consumer prices rose 2.4% from a year ago in November — down from 2.9% the previous month and less than the estimates of all economists in a Bloomberg poll. Price pressures continued easing across almost all categories and remained at a two-year low.

A core measure that excludes volatile components including fuel and food moderated for a fourth month, to 3.6%.

Inflation is undershooting analyst expectations across the 20-nation euro area following the ECB’s unprecedented ramp-up in interest rates. Output is waning as well, however: Gross domestic product shrank 0.1% in the third quarter, leaving the region teetering on the brink of a recession.

Figures earlier Thursday showed those two trends playing out in France, prompting money markets to bring forward wagers on the ECB lowering borrowing costs. They now fully price a quarter-point cut by April, compared with June just over a month ago.

Markets are betting on four quarter-point reductions in 2024 — up from three last week — and are assigning a 70% chance of a fifth, which would bring the deposit rate back to 2.75% from a record 4% currently.

ECB officials are adamant, however, that monetary policy must remain tight to ensure inflation makes it all the way back to 2%.

Greek central-bank chief Yannis Stournaras, normally among the most dovish voices on the 26-member Governing Council, said this week that he doesn’t expect rates to be reduced before mid-2024. Bundesbank President Joachim Nagel said it’s premature to even mention cuts.

Indeed, inflation is likely to tick higher before returning to target due to statistical effects and the wind-down of measures deployed last year by governments to offset soaring energy prices.

President Christine Lagarde has warned price gains may quicken “slightly” in the coming months and Bloomberg Economics’ Nowcast for December points to a reading of 3.2%.

There are also question marks over how much of the rapid policy tightening — 450 basis points of rate hikes in little over a year — is still to hit the economy.

The process is clearly visible in the financial sector, with lending to firms last month showing a first annual drop since 2015. A real estate boom underpinned by rock-bottom rates has also come to an end. Austria’s Signa became a prominent casualty when the centerpiece of the sprawling property and retail group filed for insolvency this week.

The labor market has been holding up, however, with separate numbers Thursday showing euro-area joblessness staying at 6.5% in October.

But in his debut speech on monetary policy, Bank of Italy Governor Fabio Panetta cautioned the ECB against needlessly harming the economy.

“Disinflation is well under way,” he said in Rome. “We need to avoid unnecessary damage to economic activity and risks to financial stability, which would ultimately jeopardize price stability.”

--With assistance from Joel Rinneby, Barbara Sladkowska, Constantine Courcoulas, Andrej Sokol (Economist), Alessandra Migliaccio and Craig Stirling.

(Updates with markets, Nowcast, Panetta starting in sixth paragraph.)