The recent increase in oil prices won’t derail the European Central Bank’s fight to tame inflation, according to Governing Council member Francois Villeroy de Galhau.

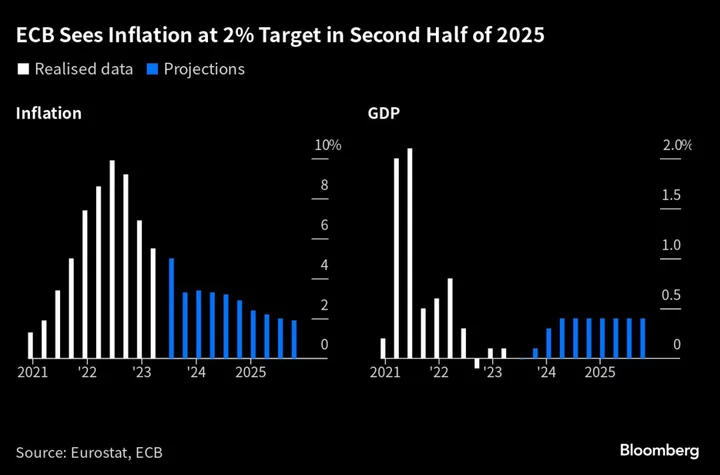

“We’re very attentive, but doesn’t put into doubt the underlying disinflation,” he told France Inter radio on Saturday. “Our outlook and engagement is to bring inflation to around 2% in 2025.”

The ECB’s latest inflation forecast — which predicts consumer-price growth slowing to that level — is based on an estimate of a $82.7-per-barrel oil price this year dropping to $77.9 in 2025.

Yet the recent jolt in crude suggests that $100 per barrel is back in play. That’s presenting central bankers with a reminder that the era of volatility heralded by the pandemic and war in Ukraine isn’t going away.

The ECB last week hiked borrowing costs for a 10th straight time to bring the deposit rate to a record 4%. Villeroy, who heads the French central bank, reiterated to France Inter that this level should be maintained to control inflation — comments that indicate he doesn’t favor future increases at this stage.

“From today’s perspective, patience is more important than raising rates further,” he said.