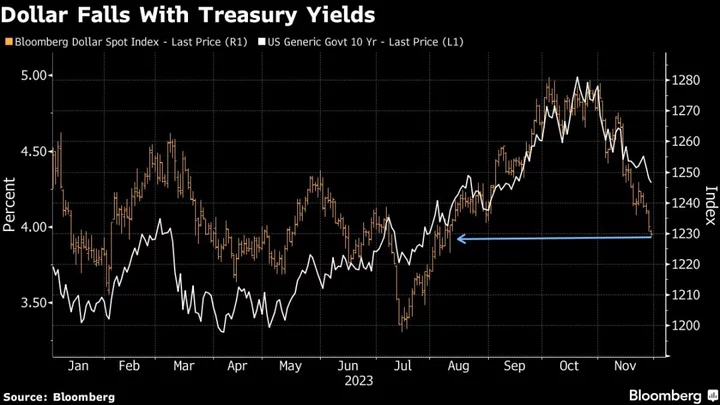

The dollar slid to the weakest level since early August as swap traders ramp up bets the Federal Reserve will cut interest rates as early as May.

The Bloomberg Dollar Spot Index fell for a fifth day as fears of a recession and dovish Fed commentary spurred investors to wager the central bank will have to reverse its most aggressive tightening cycle since the 1980s.

Elsewhere, New Zealand’s dollar led gains among Group-of-10 peers after the nation’s central bank warned more hikes may be coming next year, while the yen strengthened to a two-month high as jitters over higher US rates waned.

“The dollar remains vulnerable until we see a shift in market expectations for the Fed and that may be a 2024 story,” Win Thin, global head of currency strategy at Brown Brothers Harriman & Co., wrote in a note. “With the dollar rally stalled, it will take some firm real sector data to challenge the current dovish Fed narrative.”