US shoppers will spend up to $12.4 billion online during Cyber Monday, according to Adobe Inc., which adjusted its initial forecast of $12 billion upward based on stronger-than-expected spending on Black Friday and the popularity of buy-now-pay-later features that let shoppers stretch their budgets with credit.

It would cap off a Cyber Week that has already seen record online spending: Black Friday topped projections at $9.8 billion, up 7.5% from a year earlier. Thanksgiving spending of $5.6 billion was up 5.5%, according to figures released early Monday from Adobe.

Flexible spending options, including buy-now-pay-later features online, have helped shoppers stretch budgets otherwise battered by inflation. Consumers used such promotions to spend $7.3 billion from Nov. 1 to Nov. 26, up 14% from a year ago, according to Adobe, underscoring how credit is helping retailers spur spending.

The adjusted Cyber Monday forecast follows a robust Thanksgiving weekend for US retailers, which generate much of their sales and profits during the annual shopathon. US shoppers spent $10.3 billion online Saturday and Sunday, up 7.7% from a year earlier. Analysts are closely watching holiday shopping this year to assess the American consumer’s staying power as pandemic-era savings dwindle and interest rates remain at a 20-plus-year high.

“An uncertain demand environment pushed retailers to deliver big discounts this season, while also fortifying their e-commerce services with flexible payment methods,” said Vivek Pandya, a lead analyst at Adobe Digital Insights. “Consumers have taken note and spent at record rates during the big shopping days, despite dealing with rising costs in other parts of their lives.”

The S&P 500’s Retailing Index rose less than 1% on Monday. Shopify Inc. shares surged as much as 5.2% after the Ottawa-based e-commerce company said merchants set a Black Friday record with a combined $4.1 billion in sales.

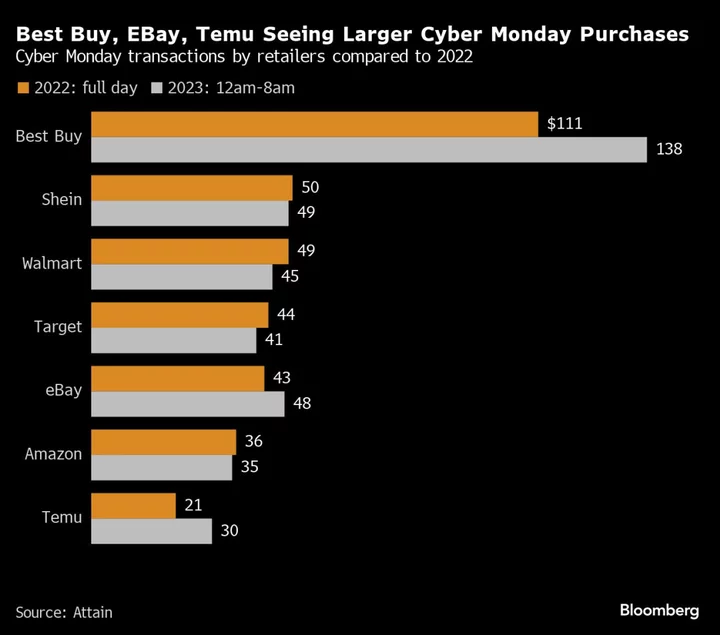

Average transaction sizes for most large retailers, including Amazon.com Inc., Walmart Inc. and Target Corp., were down slightly in the first eight hours of Cyber Monday compared with a year earlier, according to data compiled by researcher Attain. The exceptions were Best Buy, Temu and eBay, which all saw average transaction sizes increase in early shopping.

The data show shoppers are resilient and curious about shopping on new platforms such as Temu and Shein, said Brian Mandelbaum, chief executive officer of Chicago-based Attain, which gleans insights from credit-card transactions. “These emerging platforms like Temu are attracting new consumers and have an opportunity to chip away at market share from established giants like Amazon,” he said.

Big sale days like Black Friday and Cyber Monday have been gradually losing their cachet as shoppers spread their spending over longer periods. Still, with inflation-stung consumers watching their budgets, retailers increasingly count on these events to see what products shoppers are clicking on — then targeting them with bigger discounts as the clock counts down to Christmas.

Most retailers recycled their same Black Friday discounts on Cyber Monday, meaning shoppers who waited aren’t getting a better deal than if they’d made the purchase a few days ago, said Kristin McGrath, an editor at RetailMeNot, which monitors deals.

“A lot of people ask if they should wait for Cyber Monday, but this year we’re just seeing a lot of the same Black Friday deals across the board,” she said.

Hot items included Barbie dolls, Lego sets, the Nintendo Switch, headphones and smartwatches, according to Adobe, which tracks 1 trillion visits to retail websites and monitors sales of more than 100 million products. Electronics and toys were among the most heavily discounted items, according to Adobe.

Total online sales for November and December combined is set to reach $228 billion, up 4.8% from last year, according to the firm.

(Updated with data about transaction sizes in sixth paragraph)