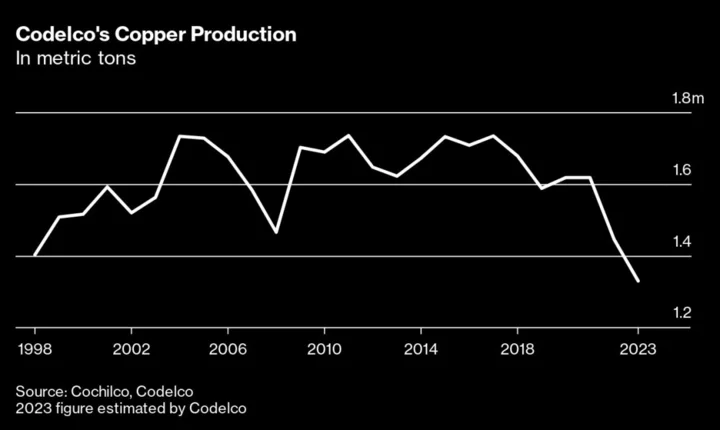

Codelco is facing the possibility of a credit rating cut as slumping production, rising costs and project disruptions dim leverage metrics at the world’s biggest copper supplier.

Moody’s Investors Service placed Codelco ratings under review for downgrade, the firm said in a statement Tuesday, citing major operational challenges and structural declines in ore grades. Moody’s rates Codelco A3, its fourth-lowest investment grade.

Read More: The Green Energy Transition Has a Chilean Copper Problem

“The review for downgrade reflects the likelihood that production volumes will not materially improve in the short term and will remain below historical levels in the next 12 to 18 months, which will weigh on Codelco’s profitability, leverage and coverage metrics,” Moody’s wrote.

The review underscores the challenges facing Ruben Alvarado, the former head of Santiago’s subway, who will take over as chief executive officer of Chile’s Codelco on Friday. He’ll be tasked with steadying the ship as mine mishaps and project delays exacerbate the impact of deteriorating grades at aging mines.

The state-owned company faces the risk that debt, standing at $19 billion, could balloon to $30 billion in four years, pushing leverage to the limit, according to a report by research center Cesco.