If world leaders and the heads of multilateral development banks gathered at a Paris summit recognise that climate goals depend on revamping the architecture of global finance, it would be a "historic" development, a top development economist said Thursday.

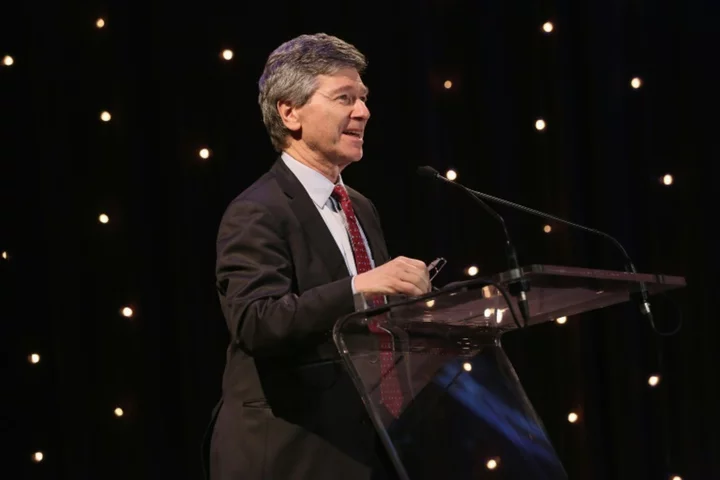

AFP put questions to Jeffrey Sachs -- a long-time advisor to the IMF, World Bank and several UN secretary-generals, and currently director of Columbia University's Center for Sustainable Development -- on the margin of the two-day Summit for a New Global Financing Pact, which ends Friday.

Q. How important is this summit for tackling the multiple crises besetting the world?

A. World leaders and global institutions are finally close to acknowledging that the global financial architecture is not up to the challenge of meeting the 17 Sustainable Development Goals and the Paris Climate Agreement.

The specific actions called for at this summit, such as scaling up the financing of the multilateral development banks, are an important step forward.

Q. What three concrete measures would show that this summit can move the dial?

A. First is the scaling up of financing by the World Bank and regional multilateral development banks (MDBs) from around $100 billion per year to around $500 billion per year. The G20 should agree on this in Delhi in September.

Second is orienting all institutions -- UN agencies, the IMF, WB, regional MDBs, national governments -- around long-term plans to achieve the UN's Sustainable Development Goals, as well as the Paris Agreement. Ideally, we should add biodiversity targets under the Kunming-Montreal Biodiversity Framework, and ocean targets under the High Seas Treaty.

Third is ending the geopolitical battles between the US and Russia, and between the US and China. The US wants to be the global hegemon but those days are long past. The rest of the world needs to tell the US to cooperate, not to try any longer to dominate. We need broad international cooperation.

Q. How important is this summit for December's COP28 climate summit in Dubai?

A. If the leaders here confirm clearly and boldly that the global finance architecture needs to be fixed to enable the SDGs and the Paris Agreement, the summit will be historic.

Q. What's the right ratio of public and private finance?

A. It depends on the sector. Public financing is especially vital for several crucial "big-ticket" areas: health, education, biodiversity conservation, climate resilience, urban infrastructure, public transport, inter-urban road networks, power transmission, and social protection.

Private financing is potentially available for independent power generation, digital connectivity, and industrial sectors. So-called blended financing -- public plus private financing in a structured program -- is vital for various dimensions decarbonisation such as the electrification of vehicles, urban water and sewerage, and universal internet access.

Q. As climate impacts deepen, the billions needed to address adaptation and losses from climate-amplified weather disasters will turn to trillions. Where will the money come from?

A. There are two issues here. The first is the cost of the transformation to zero-carbon energy. The incremental costs of a zero-carbon energy system above a fossil-fuel energy system are not huge.

Zero-carbon systems are more capital intensive and thus more expensive in the short-term, but the saving on fuels in the future make the "levelized" cost of zero-carbon systems roughly the same as fossil-fuel system. Still, energy is capital-intensive: the world will need to spend trillions of dollars each year for energy.

The second issue is the cost of adapting to climate change. The longer we delay in ending greenhouse gas emissions, the more costly will be the adaption costs and the losses and damages from disasters. Each year, the world is already suffering hundreds of billions of dollars from disasters, and perhaps trillions per year in chronic lost productivity from climate change.

mh/pvh