Chipotle Mexican Grill Inc.’s second-quarter sales fell just short of expectations and the burrito chain’s third-quarter outlook suggested momentum is slowing. The shares fell in late trading.

The results show the company may need more work to maintain the rapid growth that investors have grown accustomed to. While Chipotle has revitalized its performance in recent years and added new menu items, such as a chicken al pastor limited-time offer, some analysts had expected the company to outperform expectations.

The shares fell 7.9% at 4:46 p.m. in extended New York trading. The stock has advanced 50% in 2023 through Wednesday’s close, exceeding the S&P 500 Index’s 19% gain.

The key measure of same-store sales rose 7.4% in the period, the company said Wednesday, trailing the average analyst estimate of 7.7%. Chipotle sees that metric rising in the “low to mid-single digit range” in the third quarter, implying a slowdown from the previous period.

For the full year, Chipotle sees comparable sales growing in the mid to high-single digit range. The company expects to open as many as 285 new restaurants.

Restaurant operating margins rose from year-ago levels because of rising sales and lower avocado prices. Chipotle’s earnings per share, excluding some items, were $12.65, while analysts expected $12.25.

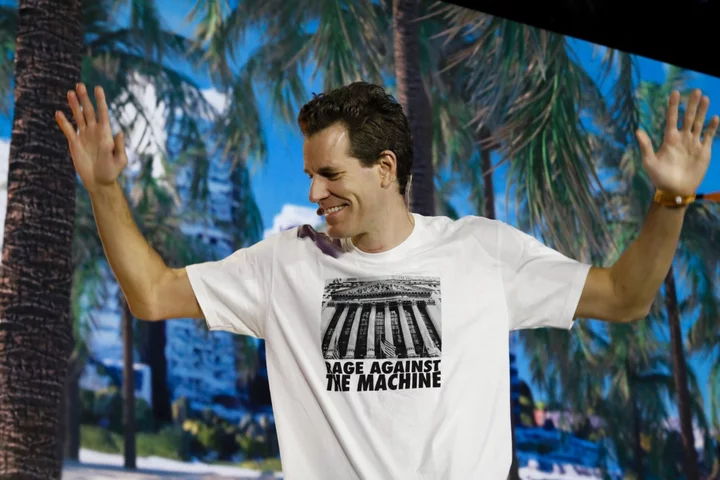

In a call with investors, Chief Executive Officer Brian Niccol said the company isn’t seeing customers pulling back.

“We’re not seeing any weakness in the lower-income consumer,” Niccol said. “If anything, they’ve continued to improve, and we’re feeling really good about the value proposition we’re providing all income levels.”

--With assistance from Reade Pickert.

(Updates market trading and adds quote from CEO.)

Author: Daniela Sirtori-Cortina and Diana Carolina Bravo