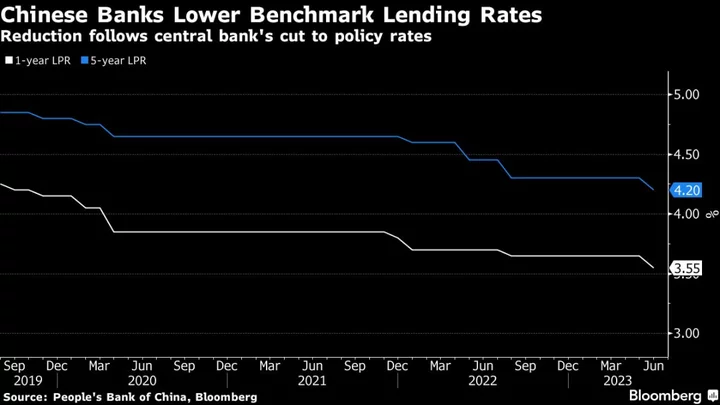

Chinese banks lowered their benchmark lending rates for the first time in 10 months following a reduction in policy rates by the central bank to bolster a slowing economy.

The one-year loan prime rate was reduced by 10 basis points to 3.55%, according to a statement by the People’s Bank of China on Tuesday, in line with the forecasts of almost all 11 economists surveyed by Bloomberg.

The five-year rate, a reference for mortgages, was cut by the same magnitude to 4.2%. Some economists had predicted a bigger reduction of 15 basis points to provide more support to the ailing housing market.

The LPRs are based on the interest rates that 18 banks offer their best customers and were last reduced in August. The easing was largely expected as the rates are quoted as a spread over the rate on the central bank’s one-year policy loans, or the medium-term lending facility, which was lowered last week by 10 basis points.

Expectations of further policy stimulus and monetary easing have risen since the PBOC’s surprise interest rate cuts last week. Official data showed the economy’s post-reopening recovery is fast losing steam, while a rebound in the property market is also fizzling. Economists are calling for a further reduction in the amount of cash banks must keep in reserve as well as more rate cuts later this year.

The central bank’s easing has already pushed the average mortgage rate to a record low. Earlier this year, authorities extended measures to allow lower mortgage rates for first-time home buyers in some cities. Banks have also been allowed to reduce their deposit rates, in order to preserve their shrinking interest margins.