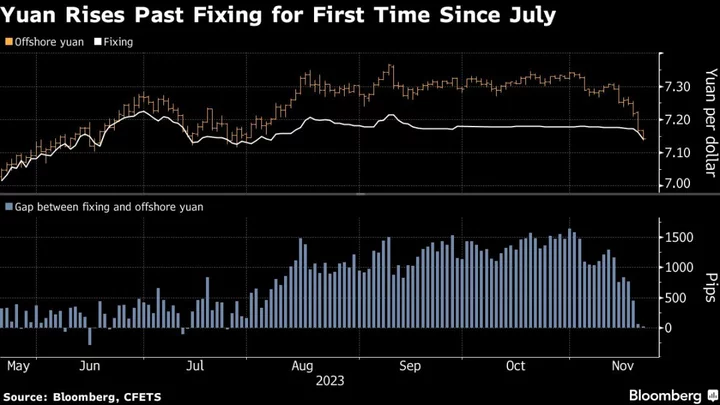

China’s yuan strengthened beyond its daily reference exchange rate for the first time in four months, getting some respite from months of depreciation pressure as the dollar weakens globally.

The yuan gained 0.4% in both onshore and overseas trading to strengthen past the daily currency fixing set by the People’s Bank of China for the first time since July. Beijing allows the yuan to trade 2% above or below the reference rate in the domestic market.

The yuan is among the worst performers in Asia this year, even as China has taken a suite of measures to slow its slump amid a patchy economic recovery. The pressure on the currency has eased considerably this month, thanks to the dollar’s retreat as expectations grew for peaking US interest rates and fresh signs of thawing ties between Beijing and Washington.

The PBOC raised its fixing by 0.3%, the most since July, to 7.1406. The yuan climbed to a four-month high in both onshore and overseas markets.

“Fixing continues to signal that the policymakers want the yuan to adjust to reflect recent market developments,” said Christopher Wong, strategist at Overseas Chinese Banking. “The strategy of buying time to wait for the dollar’s turn paid off once again.”

(Updates throughout.)