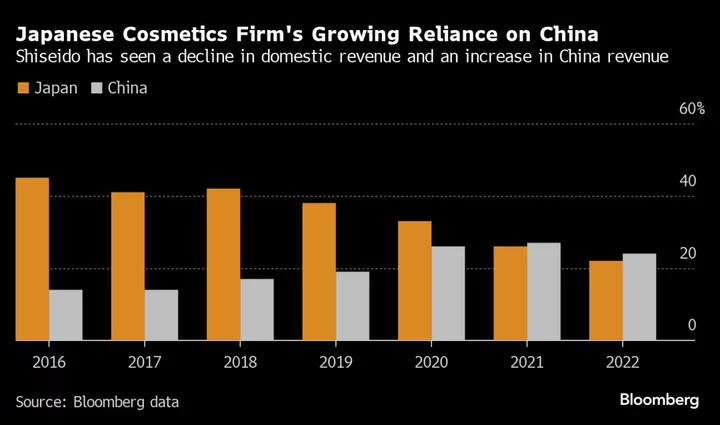

As companies battle to grab a bigger share of Asia’s growing cosmetics market, they’re receiving an unhappy reminder that relying too much on sales in China can come back to hurt them.

Japanese cosmetics firms including Shiseido Co. are getting hit by a double whammy in their China business: a slowdown in the world’s second-biggest economy and calls by online users for a boycott of Japanese products to protest the release of treated waste-water from the Fukushima nuclear power plant.

Shiseido shares tumbled the most in 36 years on Monday after it slashed full-year profit forecasts on sluggish China demand. Around 25% of Shiseido’s sales are in China and 80% of travel retail — purchases at duty-free shops and on transports — were made by the nation’s customers, according to Morningstar. Competitors like Tokyo-based Pola Orbis Holdings Inc. and South Korea’s Amorepacific Corp. also saw their third quarter operating profits miss analyst estimates.

“A reduction in cosmetics companies’ growth rates is also expected, especially Japanese and Korean firms that have benefited more than others from China’s expansion,” said Wakako Sato, an analyst at Mitsubishi UFJ Morgan Stanley Securities Co. Sato is the only one among 12 analysts rating Shiseido sell-equivalent, and she ranks No. 1 among analysts covering Japan’s personal-care sector, according to data compiled by Bloomberg.

By contrast, Shiseido’s rival Kose Corp., which is less dependent on China sales, reported operating income that beat analyst estimates, sparking a surge in its share price.

“The most important difference is probably the domestic sales contribution,” said Jeanie Chen, an analyst at Morningstar. “Kose’s two prestige brands, Decorte and Albion, contribute close to half of overall sales, while Shiseido’s sales are more skewed towards mid-priced products.”

Kose’s most popular skin care product online in Japan, Decorte Liposome Advanced Repair Serum, for instance, costs 12,100 yen ($80), while Shiseido’s No. 1 skin care product on the web, Elixir White Brightening Lotion, is sold at just over 3,000 yen.

Sato downgraded Shiseido to underweight in October 2021, and her price target of 5,000 yen is the lowest among analysts, but above its actual price of 4,480 yen on Wednesday.

Shiseido expanded its China business rapidly in the 2010s, and the country overtook Japan as its biggest market in 2021. Kose’s China sales are more like mid-teens as a percentage of the total, said Chen at Morningstar.

While analysts expect China’s economic output to slow further in coming years, a more immediate question is how long the protests over the waste-water release will continue.

“We are still expecting the impact to basically last until the next first half,” Chen said. “The impact will be temporary and eventually the Chinese government will find a way to soften this anti-Japan sentiment.”

China-Dependent Japan Stocks Drop on Boycott Over Wastewater

In the meantime, companies should regain strength in the domestic market if they want to beat the competition, according to Mitsubishi UFJ Morgan Stanley’s Sato.

“Companies have been focusing mainly on overseas expansion, starting with China,” Sato said. “From now on, they should first focus on earning money in their homeland.”