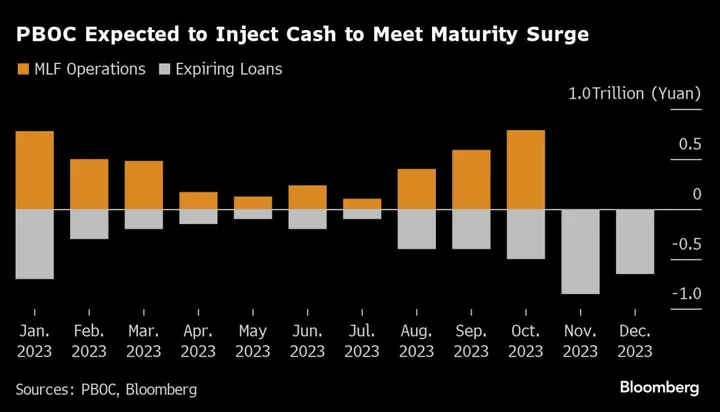

China will probably add more cash into the financial system this week as the largest amount of policy loan in a year come due. Some market watchers also expect a near-term reduction in banks’ reserve requirement ratio.

The People’s Bank of China will offer 950 billion yuan ($130 billion) through the medium-term lending facility Wednesday, according to the median estimate of 10 analysts in a Bloomberg survey. That would exceed the 850 billion yuan maturing this month. Most economists expect the one-year policy interest rate to remain unchanged at 2.5%.

Liquidity conditions have tightened as a deluge of bond issuance to fund fiscal stimulus, along with year-end cash demand from corporates, drove up money market rates. A spike in short-term borrowing costs late last month rattled markets, putting pressure on the PBOC to keep funding costs stable and facilitate the economic recovery.

Should Wednesday’s liquidity infusion prove modest, expectations that Beijing will reduce the amount that banks have to set aside as reserves may gather traction. Even if the PBOC offers around 1 trillion yuan as some economists project, which would be the most since 2021, the net injection will still trail that of the previous month due to maturing loans.

Mizuho Securities Co. and ANZ Bank China Co. are among those expecting a reduction in the required ratio in the coming weeks.

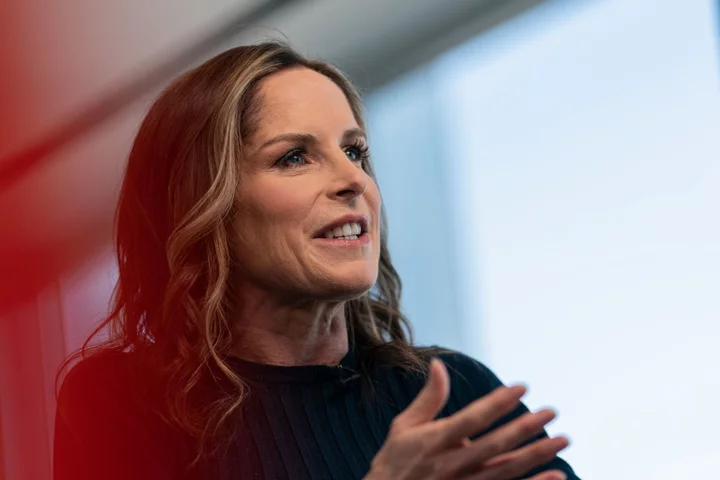

“The odds for an imminent reserve-requirement ratio cut is very high given structurally tight funding on the back of recent stronger primary issuance and to facilitate smooth issuance of upcoming special government bonds,” said Becky Liu, head of China macro strategy at Standard Chartered in Hong Kong. “The PBOC will watch out for liquidity stress more carefully given the episode at end-October.”

A reduction of 25 basis points in the required ratio would release around 500 billion yuan into the financial system, according to Bloomberg Intelligence.

Here are the survey results:

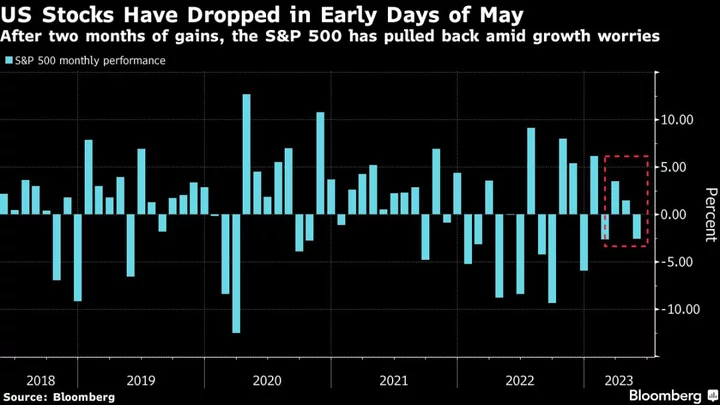

As authorities ramp up fiscal spending, banks are facing the dueling tasks of absorbing government bond supply while boosting lending to invigorate domestic demand. That’s made liquidity management increasingly complicated in recent months, especially as the country faces huge capital outflows across stocks, bonds and foreign direct investment.

The bond supply bonanza is expected to continue in the months ahead, with the Ministry of Finance planning an additional one trillion yuan in sovereign bonds in a rare mid-year revision to the fiscal budget. That comes after central and local governments took their borrowing spree in October to a new monthly high for the year.

“PBOC will likely rollover as keeping liquidity balanced amid all the extra issuances is crucial at this juncture,” said Lin Jing Leong, a senior emerging market sovereign analyst at Columbia Threadneedle Investments in Singapore. They likely don’t want to risk “liquidity tightening up and seizing the market when they are trying to support growth,” she said.

Here are the key Asian economic data due this week:

- Monday: Japan PPI, Japan machine tool orders

- Tuesday: New Zealand food prices

- Wednesday: China retail sales, China industrial production, China fixed-asset investment, Japan 3Q GDP, Japan industrial production, New Zealand home sales, Australia wages, Indonesia trade, Philippines overseas remittances, South Korea jobless rate

- Thursday: China new home prices, Japan core machine orders, Japan trade, Philippines rate decision, Hong Kong jobless rate

- Friday: Malaysia 3Q GDP, Singapore trade

--With assistance from Jing Zhao.