Emerging-market stocks drifted lower after a four-week rally as concerns about China’s economic recovery returned and investors assessed whether the euphoria about Federal Reserve policy and easing inflation is justified.

The MSCI Emerging Markets Index slipped 0.2% in early European hours after data showing slower industrial-profit growth in China underscored persistent deflation pressures. The currency gauge rose marginally, led by the Thai baht and Indonesian rupiah, amid broad dollar weakness, while sovereign risk premiums eased.

Read more: China Industrial Profit Growth Eases as Deflation Persists

Emerging-market assets are heading for the biggest monthly gains since January since easing US inflation boosted wagers the Fed has reached the peak of its monetary-tightening cycle and may even cut rates in 2024. Stocks have added $1.7 trillion after a low in late October, while sovereign bond yields have shed 84 basis points on average. Carry returns are improving as 19 of 30 widely traded developing-nation currencies head for monthly rallies.

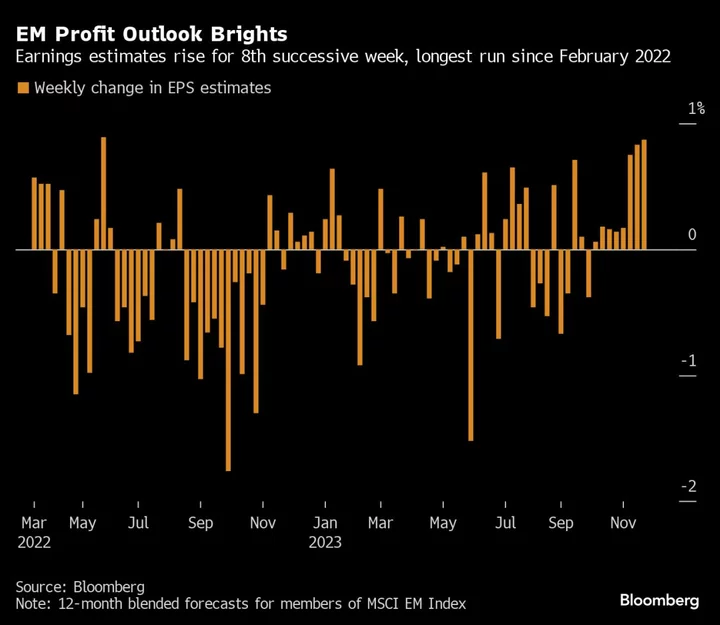

“Despite the prolonged EM underperformance relative to the S&P 500, EM equities may see a significant turnaround in 2024, backed by strong economic fundamentals and a favourable earnings growth trajectory,” said Nenad Dinic, a strategist at Bank Julius Baer & Co in Zurich. “After a dip in 2023, EPS are expected to grow at twice the rate of those in developed markets over the next two years, historically a key driver of relative outperformance.”

Despite Monday’s pause, sentiment is improving for emerging-market stocks after a roller-coaster year sent them to a record low against US stocks. As bets for a dovish Fed in 2024 built up, analysts have upgraded earnings estimates for companies in the MSCI gauge for eight successive weeks, the longest run since February 2022. That’s sent emerging-market stocks to a valuation discount of 39% versus their US peers, approaching the widest level in a year.

Flows into developing-nation equities are improving. BlackRock Inc.‘s exchange-traded fund that buys equities outside China capped seven successive weeks of net deposits, drawing a combined $2.1 billion. That, combined with the equity gains, has boosted the fund’s assets by almost 50% in this period.

Read more: Pitfalls Lie in Wait for Emerging Markets After Bumper Month

Meanwhile, optimism on Turkey is surging over its return to orthodox monetary policy. The country’s banks jumped the most in a month after Bank of America Corp. issued buy recommendations on major private-sector lenders.

Meanwhile, investors poured $20 million into bond funds dedicated to emerging markets during the week ending Nov. 21, following a 16-week streak of outflows, BofA said, citing EPFR data.

In the day ahead, investors will watch interest-rate decisions from Israel and Ghana.

Israel may seize on the rapid improvement in markets and consider easing monetary policy as early as this week or the start of next year, a shift that will depend on the central bank’s confidence it’s contained the worst of the economic fallout from the war with Hamas. The shekel was weakening versus the dollar before the decision.

The Bank of Ghana is set to keep borrowing costs unchanged for a second straight meeting amid tame price pressures, as it awaits a debt restructuring deal with bilateral creditors.

Read more: Ghana Set to Hold Rates on Disinflation, Debt Deal

--With assistance from Selcuk Gokoluk.