Japan is leaving China behind as Asia’s two largest stock markets compete for investor capital, with the latter’s prospects clouded by long-running concerns about economic growth and geopolitical tensions with the West.

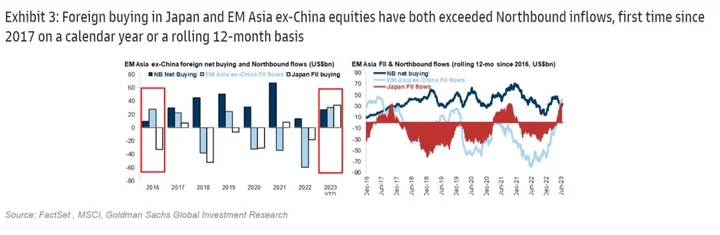

Foreign buying of Japanese equities has exceeded that of Chinese peers for the first time since 2017, according to a Goldman Sachs Group Inc. report, which cited data for the first six months of the year. Long-only managers continued to sell stocks in China and Hong Kong on a net basis in July despite a sharp rally, while buying shares in Japan, strategists at Morgan Stanley wrote in a report last week.

The tide has turned in favor of Japan as global funds pile into a market they once shunned due to concerns over lackluster earnings growth. Optimism is running high even after the Bank of Japan adjusted its accommodative stance, as investors seek alternatives to Chinese equities amid a lack of conviction that Beijing’s pledges to support a faltering economy will bear fruit.

“There were two main policy events in Asia in the last week of July, the BOJ meeting and the Politburo meeting, none of which change our view of Japan equities outperforming China,” said Frank Benzimra, head of Asia equity strategy at Societe Generale SA. “The reason is that we get increasing signs that the monetary policy normalization in Japan is going to be extremely gradual, which means the yen is not rapidly re-appreciating.”

READ: China Rally Is Just an Opportunity to Sell for Many Global Funds

Allianz Oriental Income, an Asia-focused fund with $1 billion in assets, has been boosting holdings of Japanese equities at the expense of China as part of a reallocation across the region. Japan’s weighting in the fund stood at 40% at the end of June, five times its China exposure, according to a factsheet.

The fund has returned 14% in the past year to beat 96% of its peers. Its weightings for Japan and China were 25% and 16%, respectively, as of end-2022.

Even a potential appreciation of the yen if the BOJ abandons its yield-curve control will not be a dampener, as “the stock market will fare better than people can imagine,” said Stuart Winchester, senior portfolio manager for the fund.

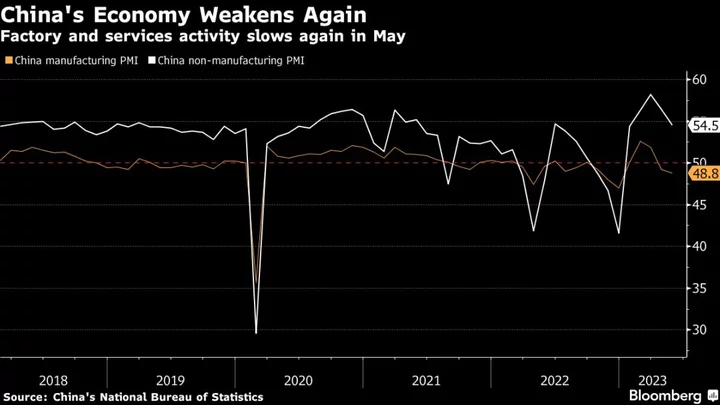

An MSCI Inc. gauge of Japan stocks has jumped 21% in 2023 as the nation’s corporate governance reforms and an endorsement from Warren Buffett lured buyers. Being second only to China in the Asia Pacific region in terms of size, the market has proved to be a lucrative alternative for global investors at a time when China’s economy is showing symptoms of a Japan-style stagnation. The MSCI China Index is up just 0.5% for the year.

BOJ Boost

The BOJ’s latest policy adjustment removes an overhang that will pave the way for stocks to rise further, according to strategists at Morgan Stanley and Goldman Sachs Group Inc. Global funds snapped up 196 billion yen ($1.38 billion) of Japanese stocks in the week ended July 28, according to official data. They have been buyers in all but one week since the end of March.

“Japan is the third-largest economy in the world, and therefore having some exposure in an investment portfolio has a lot of merits,” said Oliver Lee, client portfolio manager at Eastspring Investments. The nation is “well placed to benefit from some of the geopolitical tension in the region through the diversification of supply chains,” he said, given Japanese firms have the know-how in manufacturing and automation.

In contrast, there are doubts that a recent upturn in Chinese shares can be sustained even after authorities issued a rare pledge to rejuvenate the capital market. Morgan Stanley last week cut its rating on the nation’s equities to equal-weight, urging investors to take profit after the recent rally. Japan remains its top pick in global equities.

*Source: Goldman Sachs report

To be sure, some are calling for caution after the sharp surge in Japanese stocks, given concerns about the yen’s outlook and the market’s sensitivity to the global risk-off backdrop seen after Fitch Ratings’ downgrade of the US. The MSCI Japan gauge has dropped 2.7% since hitting a 33-year high on Aug. 1. July was a seventh straight month of gains for the index.

Valuations are also starting to look less attractive, with Japanese shares trading at close to 15 times the one-year forward earnings versus a ratio of 10 times for their Chinese peers.

READ: Hopes Run High for Chinese Stocks as Beijing Targets Consumption

Still, optimism over Japan equities likely has the potential to hold for now given investors’ rejigging of portfolios in the country’s favor.

“We have been max weight in Japan for some time now and are happy with our current weighting,” said Joshua Crabb, head of Asia Pacific equities at Robeco Hong Kong Ltd. His portfolio has a more than 40% exposure to Japan and 16% to China.

Enthusiasm toward Japan equities is also evident among investors in Taiwan. Seizing the opportunity, Yuanta Securities Investment Trust Co. — the island’s largest fund company by assets managed — launched Taiwan’s biggest Japan stock fund in July.

“Japan’s outperformance would continue at a moderate pace,” said Rie Nishihara, chief Japan equity strategist at JPMorgan Chase & Co. “We are waiting to see how the market further reacts, however it seems to have digested the yield curve control revision as an evidence of ending deflation and a good transition.”

--With assistance from Ishika Mookerjee, Irene Huang and Hideyuki Sano.