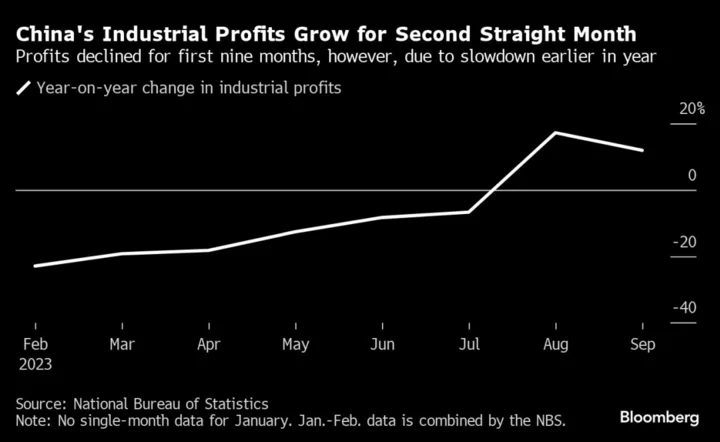

China’s industrial companies saw profits rise in September for a second straight month, in a further sign that policy support is helping the manufacturing sector recover.

Industrial profits increased 11.9% from a year earlier, according to data published by the National Bureau of Statistics on Friday. That comes after a 17.2% surge in August, which was the first expansion in more than a year.

For the first nine months of 2023, profits fell 9% from a year ago, narrowing their decline from a 11.7% drop in the first eight months of the year.

“Market demand continued to improve, and industrial production expanded stably,” NBS statistician Yu Weining said in a statement accompanying the release. A rebound in industrial product prices has led to an improvement in industrial firms’ revenue, according to Yu.

The continued improvement in industrial profits suggested demand is likely recovering as the government ramped up measures to aid growth while companies probably approach the end of a destocking cycle. Declines in factory-gate prices, indicated by the producer price index, narrowed to 2.5% in September, while manufacturing activities recorded the first expansion in six months, according to the official purchasing managers’ index.

“The profit improvement is in line with the recent rise in PPI and PMI, signaling the industry is bottoming out,” Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group.

Chinese shares gained on Friday, with the Hong Kong China Enterprises Index rising as much as 1.5%. The yield on the country’s 10-year bonds was little changed.

What Bloomberg Economics Says...

“September’s rise in China’s industrial profits provides more evidence that increased policy support is aiding a recovery in the manufacturing sector. We expect the momentum to extend into the fourth quarter and early next year as stimulus — including an extra 1-trillion-yuan boost to the budget — gains traction.”

— Eric Zhu, economist

Read the full report here.

China’s economy gained momentum in the third quarter as consumers stepped up spending on everything from restaurants to cars. Better-than-expected economic data for the three months ended September means the country will likely achieve its full-year growth target of around 5%. For September alone, industrial production maintained a 4.5% growth, better than economists’ estimates.

That said, the increase in industrial profits in the last two months was far from enough to recoup the lost earnings the companies suffered in the previous months this year. Industrial profits’ contraction in the first nine months indicates that the firms hardly benefited from the economy’s overall growth of 5.2% in the first three quarters.

The rebound has also been uneven across industry segments. For the first nine months, sectors including chemicals, fuel processing, coal mining and electronics manufacturing all recorded double-digit declines in profits. Meanwhile, electricity production and equipment manufacturing sectors recorded an increase in profits.

Uncertainty remains for industrial firms’ profitability going forward, as the housing market is still a serious drag on the economic outlook as home prices and property investment continued to contract.

“Challenges to sustainable recovery also include potential disruptions to industrial production in winter and from external demand headwinds,” said Bruce Pang, chief economist at Jones Lang LaSalle Inc.

(Updates with additional details throughout)