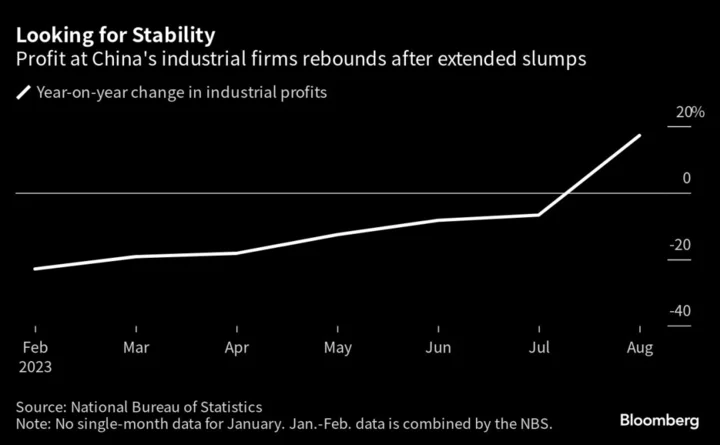

Chinese industrial profits rose in August for the first time in more than a year, a further sign the economy is stabilizing.

Industrial profits increased 17.2% from a year earlier, according to data published by the National Bureau of Statistics on Wednesday. The increase in August was the first monthly growth since the second half of last year, NBS analyst Yu Weining said in a statement.

For the first eight months of 2023, profits fell 11.7% from a year earlier.

The rise in profits suggests demand may be improving after the government ramped up measures in recent months to prop up the property market and spur consumer spending. Industrial production picked up in August, while producer price deflation eased, giving a boost to profits.

“With the steady rebound in industrial production and the improvement in the connection between production and sales, the income of industrial firms improved gradually,” NBS’s Yu said.

August’s industrial profits data show that output prices improved that month, and rises in commodity prices increased the earnings of upstream sectors, said Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group Ltd.

“If consumption improves, we can expect a continued growth of profits,” he said.

What Bloomberg Economics Says...

“August’s jump in China’s industrial profits adds to signs manufacturing activity may be starting to bottom out. Favorable base effects boosted the figures, but the overall size of the increase suggests recent policy supports are gaining traction. Given the underlying weakness in domestic and external demand, it will take time before earnings rebound consistently — and more stimulus will be needed.”

— Eric Zhu, economist

Read the full report here.

Manufacturers’ profits fell 13.7% in first eight months of the year, 4.7 percentage points slower than in the January-July period, according to the NBS.

Economic growth is stabilizing after a slowdown earlier in the year, although the ongoing slump in the housing market remains a major risk to the outlook. Economists have downgraded their growth forecasts for China steadily during the year and expect 5% expansion now.

Separately, China’s central bank on Wednesday vowed to provide “more forceful support” for the economy. The authorities will focus on implementing monetary loosening measures already introduced and keeping liquidity “reasonably ample” and credit growth at a “rational and steady pace,” the People’s Bank of China said in a statement on its third quarter monetary policy meeting.

The PBOC will “facilitate” prices to rebound and stay at reasonable levels, continue to expand support for targeted sectors including small firms, green sectors, technology innovation and infrastructures, and push to reduce financing costs through market-based reforms of banks’ benchmark lending rates and deposit rates, it said.

It also repeated a pledge to firmly prevent excessive movements in the yuan’s exchange rate and promote stable development of the property market.

(Updates with analyst’s comments, PBOC statement.)