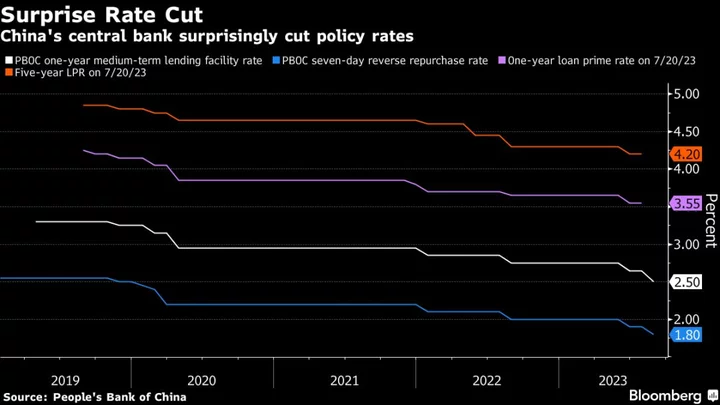

China’s central bank unexpectedly reduced a key interest rate by the most since 2020 to bolster an economy that’s facing fresh risks from a worsening property slump and weak consumer spending.

The People’s Bank of China lowered the rate on its one-year loans — or medium-term lending facility — by 15 basis points to 2.5% on Tuesday, the second reduction since June. All but one of the 15 analysts surveyed by Bloomberg had predicted the rate would stay unchanged. A short-term policy rate was also cut by 10 basis points.

The surprise move came shortly before the release of disappointing economic activity data for July showing growth in consumer spending, industrial output and investment sliding across the board and unemployment picking up.

The National Bureau of Statistics said domestic demand remains “insufficient” and the “economy’s recovery foundation still needs to be strengthened.” China needs to “step up macroeconomic policy adjustment, and focus on expanding domestic demand, lifting confidence and preventing risks,” the NBS said in a statement.

The rate cut was the first under new Governor Pan Gongsheng, a former deputy at the PBOC who was promoted last month following the retirement of Yi Gang. There’s been a slew of bad economic news since Pan has taken office, with data last week showing bank loans plunging to a 14-year low in July, deflation setting in and exports contracting further.

The PBOC’s surprise move suggests heightened concern from policymakers about the deteriorating outlook, especially in the real estate market, where another major property developer now faces a debt crisis and home sales continue to decline. Concerns over financial stability also rose following missed payments on some investment products by a financial conglomerate with exposure to the real estate sector.

“The slightly earlier timing and a larger than expected 15 basis point rate cut of MLF show that Beijing feels the urgency to take more policy easing actions to stabilize expectations and growth,” said Xiaojia Zhi, chief China economist at Credit Agricole. There’s likely to be more monetary policy easing in coming months, Zhi said.

The reduction in interest rates boosted government bonds and weighed on the exchange rate. China’s 10-year yield fell seven basis points to 2.56%, the lowest since 2020. The onshore yuan weakened for the fourth session Tuesday, falling 0.21% to 7.2731 a dollar as of 10:32 a.m. in Shanghai.

Beijing is facing more calls to add monetary and fiscal stimulus to support growth, although its response so far have been fairly muted despite a pro-growth tilt by the Communist Party’s Politburo in July. A central bank adviser has called for direct support to consumers to help boost spending, an approach that senior officials have so far been reluctant to take.

What Bloomberg Economics Says...

The People’s Bank of China’s rate cut was earlier and bigger than we expected — signaling the central bank recognizes the urgency to support the economy. The outlook has deteriorated, with the property slump triggering financial stress.

David Qu and Chang Shu

For the full report, click here.

The Chinese central bank’s easing action will add more pressure on the yuan, which fell to its weakest level since November as the economy’s growth outlook wanes. The PBOC has set its daily fixing for the currency at a stronger-than-expected level every day since late June. Top officials vowed to keep the yuan in a “basically stable” range in a key meeting last month.

“The data point to a slowing momentum and indicate that further supportive measures are warranted,” said Zhou Hao, chief economist at Guotai Junan International Holdings Ltd.

The PBOC also provided 401 billion yuan ($55 billion) of medium-term loans, slightly more than the 400 billion yuan maturing in August.

Tuesday’s data “shows how difficult it is for China’s economy to sail against the wind, with challenges from almost all dimensions and efficient policy support from few fronts,” said Bruce Pang, chief economist for greater China at Jones Lang LaSalle Inc.

--With assistance from Paul Dobson, Jing Zhao, Wenjin Lv, Jill Disis, James Mayger and Jing Li.

(Updates with additional details.)