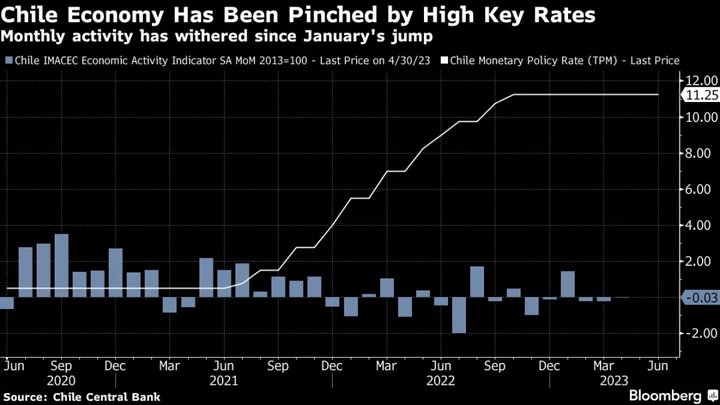

Chile’s central bank held its key interest rate unchanged at an over two-decade high in a surprise split vote, with policymakers indicating the start of a monetary easing cycle was imminent as growth stagnates.

Board members voted three to two to keep borrowing costs at 11.25% for the fifth straight meeting on Monday, as expected by all analysts in a Bloomberg survey except for one who forecast a 25 basis-point cut. Two board members voted for a half-point reduction.

Central bankers dropped guidance that they were waiting for the slowdown in inflation to be consolidated before cutting rates, saying instead that the economy was moving in the right direction. Activity was unchanged on the month in April after falling in the prior two readings, according to the most recent data. Meanwhile, the growth downturn and slower headline inflation have fueled a plunge in swap rates in recent weeks.

Read more: Central Banks Across Latin America Get Welcome Inflation News

“The Board believes that the most recent evolution of the economy points in the required direction,” board members wrote in an accompanying statement. If these trends continue, the key rate “will start a downward process in the short term. The magnitude and timing of its reduction will consider the evolution of the macroeconomic scenario and its implications for the inflation trajectory.”

Central bankers are battling inflation that was driven initially by over $50 billion in early pension fund withdrawals as well as public transfers that reached 90% of households during the pandemic. Russia’s invasion of Ukraine and the subsequent commodity cost surge in 2022 came as an additional shock.

Chile’s headline inflation slowed past all estimates to 8.7% in May, helped by a monthly drop in transportation costs. Still, a measure that excludes volatile items was 9.9%, more than triple the target rate.

The prospect of declining inflation has fueled investor bets in recent weeks that easing may be near in countries including Chile, Peru and Brazil. Meanwhile, many analysts think Mexico will start cutting rates toward the end of the year.

Two-year Chilean swap rates, an indication of the outlook for borrowing costs, have tumbled 93 basis points to 6.79% in the past month alone.

--With assistance from Giovanna Serafim and Rafael Gayol.

(Updates with central bank comments starting in the first paragraph)