President Joe Biden’s staff negotiations with House Speaker Kevin McCarthy’s office on a spending package that would avert a US default are serious and continuing, National Economic Council Director Lael Brainard said Sunday as she repeated calls for Congress to lift the debt limit.

“The staff is very engaged. I would characterize the engagement as serious, as constructive,” Brainard told CBS’s Face The Nation on Sunday, warning that a default would be “catastrophic” for the economy.

“It would lead to higher borrowing costs for cars, for mortgages, for small businesses, even for the US government and so the most important thing is making sure that Congress fulfills its basic responsibility to avert default,” Brainard said.

Biden, McCarthy and other Congressional leaders met on Tuesday and kickstarted staff-level talks on a budget deal. Biden insists those are separate from the debt ceiling and has called on Congress to raise it and give time for talks to play out; McCarthy has said an increase of the limit is contingent on a spending deal.

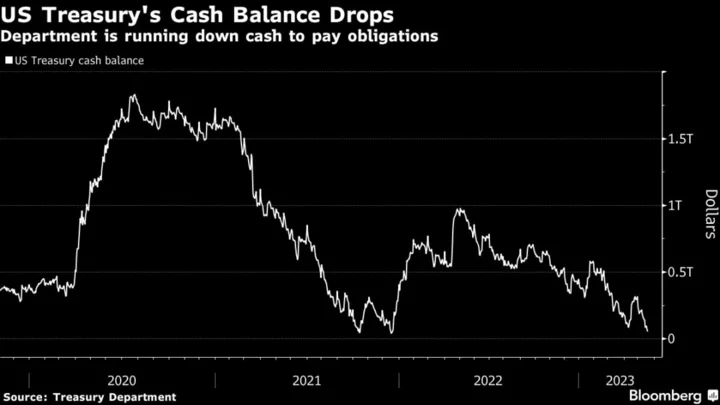

The leaders were supposed to meet again Friday but delayed that session to allow talks to play out, and cast that development as a sign of progress, not a setback. Treasury Secretary Janet Yellen has warned that the department could run out of money as soon as June 1, or in the weeks after that.

Failure to reach a deal would plunge the US into a default that would sink markets and raise borrowing costs. The top Senate Republican, Mitch McConnell, has said the US won’t default but McCarthy hasn’t offered a similar pledge.

Brainard downplayed the prospects for a short-term deal, in which the ceiling could be increased for a limited time to allow more haggling over spending.

A short term deal “is not a fix, is not really addressing that core uncertainty that CEOs are talking about,” she said, sidestepping a question about the move by JPMorgan Chase & Co.’s Jamie Dimon to set up a “war room” to prepare for a potential default.

“This is really a responsibility of Congress,” she said

And the White House has warned that it has no unilateral options that would fully avert disaster if the ceiling isn’t raised. Biden has said that any attempt to use the 14th amendment to nullify the debt ceiling would end up in litigation, and another top economic aide downplayed that option Sunday.

Biden does “not think the 14th Amendment would solve our problems now; the only thing that can solve our problems now is for Congress to lift the debt limit,” Deputy Treasury Secretary Wally Adeyemo told CNN’s State of the Union on Sunday.

Brainard, meanwhile, sought to calm fears about continued weakness in the US banking system after the failures of three regional lenders.

Those banks were “isolated problems” and “didn’t manage their risks” as interest rates rose, Brainard said.

“Those were dealt with in a way where depositors never had any question but that they would have access to their deposits, so in that sense Americans have confidence,” Brainard told CBS. “We have the tools and they can be used again. More broadly, though, the banking system is sound although we are monitoring very effectively.”

She stopped short of predicting the worst is over when asked if there would be any more bank failures. “The system overall is sound. I can’t speak to particular institutions,” Brainard said.