Stocks in Asia are set to follow a surge on Wall Street after an unexpected inflation slowdown bolstered bets the Federal Reserve’s aggressive hiking cycle is over. Treasury yields plunged and the dollar slumped.

Futures pointed to strong opens for share markets in Japan, Hong Kong and Australia, after the S&P 500 rose nearly 2%, the most since April. Tesla Inc. led gains in megacaps and Nvidia Corp. rallied for a 10th straight session. Five-year yields plunged more than 20 basis points and the dollar fell 1.2%, its biggest drop in a year.

Australia and New Zealand government 10-year yields slumped in early Asia trading, both dropping 12 basis points after a report showed US headline and core inflation in October slowing more than economists had forecast.

While Wall Street’s rally could risk further easing of financial conditions — and ultimately complicate the Fed’s job — bets on a “pivot” next year have increased. Fed swaps indicate the odds of another hike have fallen to almost zero — with the market pricing in a 50 basis-point rate cut by July.

“The last of investors not convinced the Fed is done are likely ‘throwing in the towel’,” said Bryce Doty at Sit Fixed Income Advisors. “The next Fed action is more likely to be a cut next summer than another rate increase.”

Read More: Wall Street Bears Submit as Slowing Inflation Forces Hard Pivot

Fed officials welcomed the latest data showing receding US inflation, while adding that there’s still a way to go before it reaches the central bank’s 2% target.

To Chris Larkin at E*Trade from Morgan Stanley, while the cooler-than-expected numbers will likely encourage some investors to start planning for 2024 rate cuts, the Fed will probably continue to fight that narrative.

“They’ve run a long race, and they won’t quit just because the finish line appears to be a little closer,” Larkin noted.

The drop in inflation suggests that recent monetary policy has been doing its job, which makes the prospect of a “soft landing” ever more likely, according to Richard Flynn at Charles Schwab UK. The news reinforces the probability that officials will “hold off” from further rate hikes, he noted.

An intact disinflationary process means that the Fed can “sit tight for now” — which would lower the risk of an “overly restrictive policy”, according to Lauren Goodwin at New York Life Investments. Still, she warned investors against getting “too enthusiastic” as “financial conditions are now easing again, which keeps the Fed on guard and highly data dependent.”

The Fed’s challenge is that the market tries to jump to the “endgame” — risking a larger or sooner easing in financial conditions than the Fed itself would like to see, said Krishna Guha at Evercore ISI. “So expect Fed officials to maintain a very cautious and relatively hawkish tone.”

Citadel founder Ken Griffin said the Fed risks a hit to its reputation if it cuts interest rates too quickly. Cathie Wood, the head of ARK Investment Management, said that deflation is already underway in the US across industries and will force the central bank to kick off a big interest-rate cutting cycle.

Equities have rallied in November on bets the Fed is done with rate hikes, with the S&P 500 up more than 7% in the span — and heading toward its best month since October 2022.

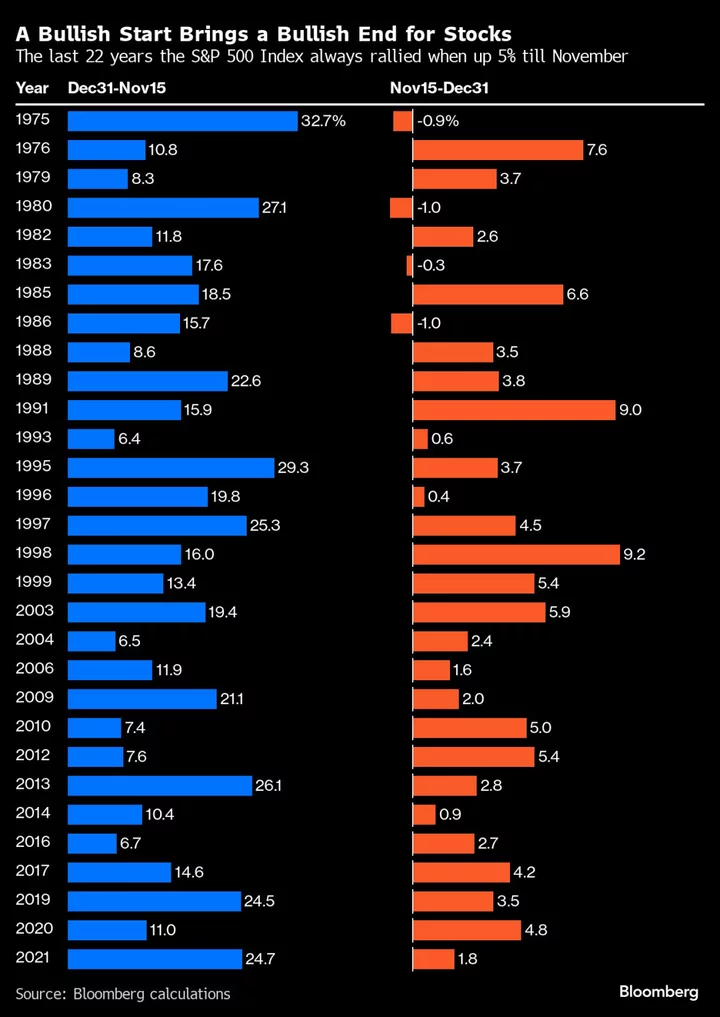

In the past 22 years, when the S&P 500 was up 5% or more by mid-November, the remainder of that year was positive every single time, according to data compiled by Bloomberg. Go back 50 years, and that setup was positive 26 out of 30 times, with the decline in the four exceptions being 1% or less.

Meantime, investors turned the most bullish on bonds since the global financial crisis amid “big conviction” that rates will move lower in 2024, according to the latest Bank of America Corp. fund manager survey.

Pacific Investment Management Co. — among the many whose expectations for a rally this year were disappointed — is renewing the call for 2024.

Bonds “have rarely been as attractive as they appear today” relative to stocks, Pimco managers Erin Browne, Geraldine Sundstrom and Emmanuel Sharef said in a report predicting “prime time” for the asset class in 2024.

Key events this week:

- China retail sales, industrial production, fixed-asset investment, Wednesday

- Japan GDP, industrial production, Wednesday

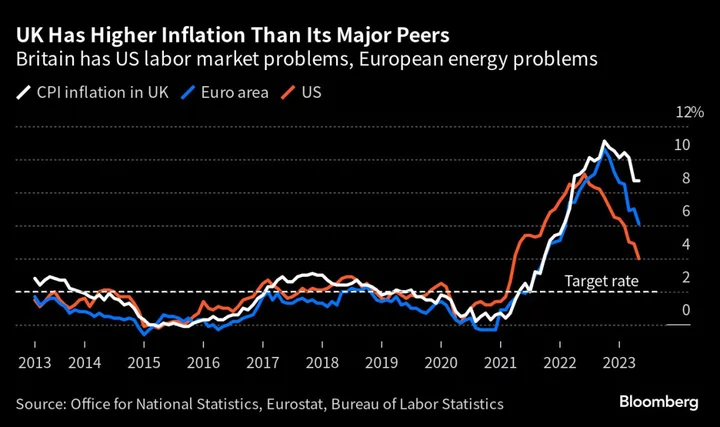

- UK CPI, Wednesday

- US retail sales, business inventories, PPI, Empire manufacturing, Wednesday

- Target earnings, Wednesday

- China new home prices, Thursday

- US initial jobless claims, industrial production, Thursday

- Walmart earnings, Thursday

- US President Joe Biden and Chinese President Xi Jinping expected to speak at APEC leaders summit, Thursday

- Cleveland Fed President Loretta Mester, New York Fed President John Williams and Fed vice chair for supervision Michael Barr speak, Thursday

- Bank of England deputy governor Dave Ramsden and ECB President Christine Lagarde speak at event, Thursday

- US housing starts, Friday

- US Congress faces a midnight deadline to pass a federal spending measure, Friday

- ECB President Christine Lagarde speaks, Friday

- Chicago Fed President Austan Goolsbee, Boston Fed President Susan Collins and San Francisco Fed President Mary Daly speak, Friday

Some of the main moves in markets:

Stocks

- Hang Seng futures rose 2.6% as of 7:39 a.m. Tokyo time

- Nikkei 225 futures rose 1.5%

- S&P/ASX 200 futures rose 1.3%

- The S&P 500 rose 1.9%

- The Nasdaq 100 rose 2.1%

Currencies

- The Bloomberg Dollar Spot Index fell 1.2%

- The Japanese yen was little changed at 150.34 per dollar

- The offshore yuan was unchanged at 7.2525 per dollar

Cryptocurrencies

- Bitcoin was little changed at $35,586.19

- Ether rose 0.2% to $1,985.25

Bonds

- The yield on 10-year Treasuries declined 19 basis points to 4.45% on Tuesday

- Australia’s 10-year yield declined 12 basis points to 4.55% on Wednesday

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.