Investors keep plowing into oil and gas stocks, brushing off warnings from some on Wall Street that the recent rally may have run its course.

Bank of America Corp. strategist Michael Hartnett said in a note Tuesday that the bank’s survey found that fund managers shifted from an 1% underweight allocation on energy stocks to an 8% overweight stance in October, the most bullish allocation since March. He said they’ve been rotating out of staples and utilities into commodities and energy over the last week.

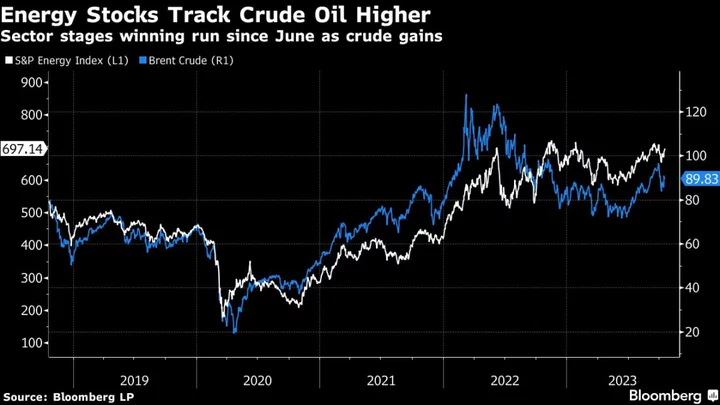

The influx comes as some Wall Street analysts are questioning whether there’s much upside left in the sector after beating the broader market in 2021, 2022 and so far during the second half of this year. The S&P 500 Energy Index has climbed 19% since the start of June, about four times the gain in the broader market.

Bernstein analyst Bob Brackett downgraded a swath of shale-oil companies Tuesday, including EOG Resources Inc. and Devon Energy Corp., saying the sector is approaching the “end of the tail” and the industry is in “mid to late cycle” for returns. He recommended investors get pickier about their energy exposure and that “wholesale accumulation” in the sector “is not the correct tactic for now.”

Others are questioning valuations in US exploration and production companies, particularly those active in the Permian Basin in Texas, following the run up in oil prices through last month.

Citigroup Inc. analyst Scott Gruber on Tuesday questioned whether premiums for producers in that region were “fully baked” and pulled his buy ratings on stocks including Devon, Diamondback Energy Inc. and Marathon Oil Corp.

Yet the 23% jump in oil prices since July is difficult for energy investors to ignore, especially since some strategists say the equities should catch up to crude’s gains. Moreover, the sector’s stocks lagged during the first half of the year, leaving the S&P Energy Index up less than 4% despite the second-half outperformance.

“Energy equities have lagged the sharp move in oil prices,” JPMorgan Chase & Co. analysts including Marko Kolanovic wrote in a note send to clients Monday, adding they are keeping their overweight rating on the sector.