BNP Paribas SA Chief Executive Officer Jean-Laurent Bonnafe said the European Central Bank shouldn’t wait long to start easing monetary policy in order to protect the euro-area economy.

“Europe has slowed down much more than the US, where activity remains at a very high level, and Germany is especially affected,” he told La Tribune Dimanche newspaper. “So we shouldn’t delay starting to lower interest rates, in order to preserve the fabric of the European economy. These decisions are for the ECB.”

The central bank’s president, Christine Lagarde, warned this month that an unprecedented tightening in financial conditions is taking hold after 10 rate increases. The institution left interest rates unchanged for the first time in more than a year on Thursday.

BNP Paribas expects rates to remain stable throughout next year, Chief Operating Officer Thierry Laborde told French radio station Radio Classique on Friday.

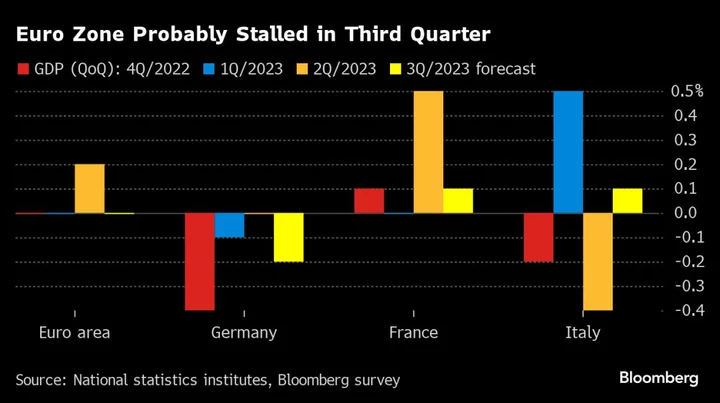

Economists surveyed by Bloomberg expect the euro-region economy stalled or even contracted in the third quarter under the cumulative weight of successive rate hikes. GDP data are due Monday from Germany, Austria and Belgium, followed by France and Italy on Tuesday.

BNP’s Bonnafe said that putting in place the energy transition will be a very expensive and long-term process for the bloc.

“Massive investment is and will be necessary,” he told La Tribune Dimanche.

The CEO added that the Paris-based lender will hit a target to increase the portion of loans to finance energy production that relate to low-carbon energy to 80% four years early in 2026.

--With assistance from Alexandre Rajbhandari.