Bitcoin added to losses racked up during the token’s worst week since November last year as the prospect of higher-for-longer borrowing costs saps demand for riskier investments across global markets.

The largest digital asset fell almost 1% toward $26,000 as of 8:33 a.m. in London on Monday, trading near a two-month low after shedding more than 10% in the seven days through Sunday. Smaller coins like Ether and XRP also slid.

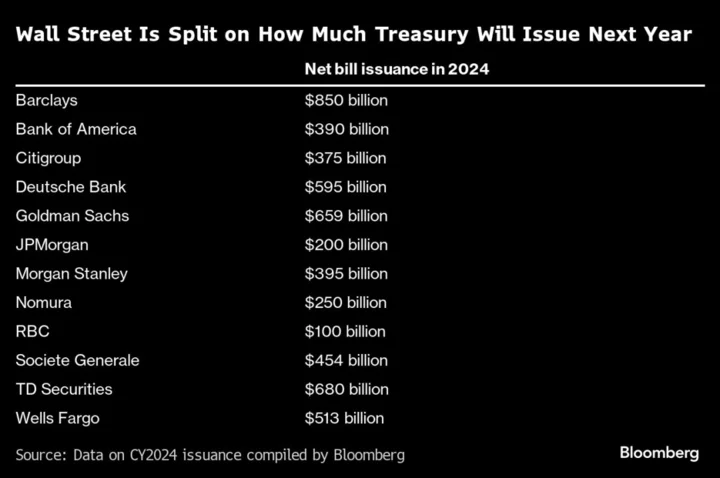

Longer term US Treasury yields are around multi-year highs, part of a global bond selloff that reflects the risk of a prolonged period of restrictive monetary settings to choke inflation. Such a backdrop portends constrained liquidity that would pose a challenge for riskier assets like stocks and crypto.

Top central bankers are due to meet in Jackson Hole this week for the Federal Reserve’s annual symposium. Fed Chair Jerome Powell’s comments due on Friday will be closely parsed for clues about the policy outlook.

“The market potentially is hoping there is going to be some dovish rhetoric coming out of Jackson Hole,” said Tony Sycamore, a market analyst at IG Australia Pty. “I don’t think they are going to be dovish.”

Sycamore expects the S&P 500 stock index to drop another 2% to 3% amid a climb in the 10-year US Treasury yield past 4.33%, with Bitcoin extending its decline to about $25,000.

The crypto industry continues to hold out hope for a tailwind from pending applications to start US spot Bitcoin and Ether futures exchange-traded funds.

“Despite the macro risk, there is a strong potential crypto catalyst in the wings: the listing of ETFs,” wrote Noelle Acheson, author of the Crypto Is Macro Now newsletter.

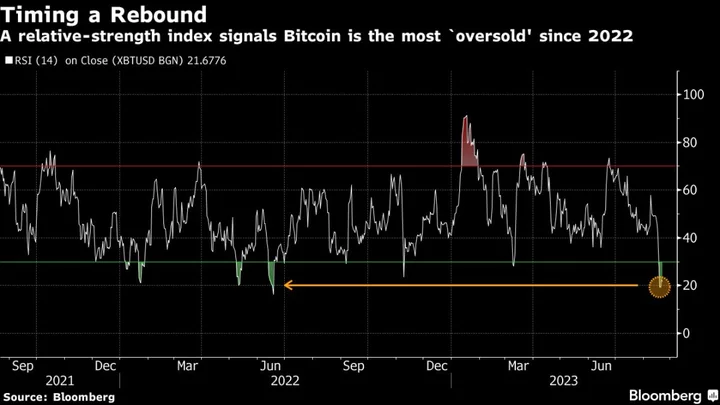

Some of the technical signals followed by chart analysts paint a mixed picture. A gauge of momentum known as the 14-day relative strength index suggests Bitcoin is close to the most oversold level since mid-2022.

An Ichimoku Cloud study — which uses mathematical formulas to help define areas of resistance and support — indicates Bitcoin may be on the cusp of a deeper retrenchment if it sinks below $25,700.

Bitcoin’s drawdown last week was the largest since the collapse of the FTX crypto exchange in the final quarter of 2022. Its year-to-date gain stands at 57%, down from 90% through mid-July.

Other metrics point to a reluctance among retail and institutional investors to engage with crypto following last year’s rout, blowups like FTX and an ever-shifting regulatory landscape.

For instance, average daily spot volumes on centralized digital-asset exchanges over the past four months were the lowest since October 2020 — when Bitcoin was at about $10,000, according to research company Kaiko.

--With assistance from Sunil Jagtiani.