By David Lawder

WASHINGTON The Biden administration on Wednesday urged big companies to deposit another $2 billion into U.S. community lenders to boost loans to minority and underserved businesses, and asked them to devote 15% of their procurement budgets to such firms.

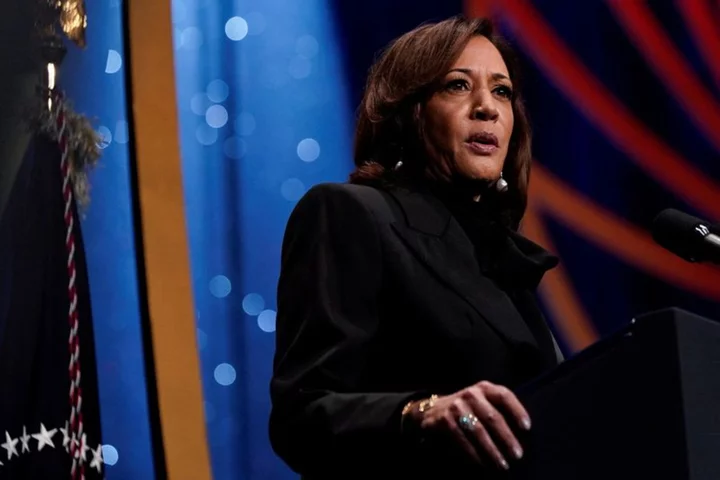

The call by Vice President Kamala Harris comes after a coalition of 30 private-sector companies and foundations met a goal set last year to attract $1 billion in deposits to these institutions. That target is now being raised to $3 billion.

Chip maker Micron Technology, industrial gases producer Air Products and utility Xcel Energy have agreed to commit at least 15% of their contract spending to "small and underserved" firms, the Treasury Department said.

Alphabet Inc's Google will commit to spending at least $1 billion annually with "diverse-owned suppliers" in the United States, the Treasury said.

The department announced the commitments as part of its third annual Freedman's Bank Forum on Wednesday, which will discuss efforts to increase economic opportunities for communities of color.

"To bridge the financial disparities that hold so many of our communities back, we must continue to work together to combine the capacity of private sector with the reach and the scale that only the government can provide," Harris said in a statement. "When we do, we create the opportunity and prosperity for millions of Americans."

The Treasury had previously invested nearly $9 billion into Community Development Financial Institutions (CDFIs) and minority-owned banking firms to make more capital available to minority firms.

"In order for these minority owned banks and CDFIs to lend that money, they need deposits," Deputy Treasury Secretary Wally Adeyemo told reporters.

According to a Treasury fact sheet, the Office of Management and Budget also is setting a goal of awarding 13% of federal contract spending to "small, disadvantaged businesses" for fiscal 2024, which started on Oct. 1.

The federal government buys about $650 billion worth of goods and services each year, making it the largest single purchaser in the country, the Treasury said.

The Internal Revenue Service will also aim to devote 19% of its procurement budget to small, historically disadvantaged businesses as it upgrades its technology, customer service and audit capabilities under a 10-year, $60 billion investment plan.

(Reporting by David Lawder; Editing by Sonali Paul)