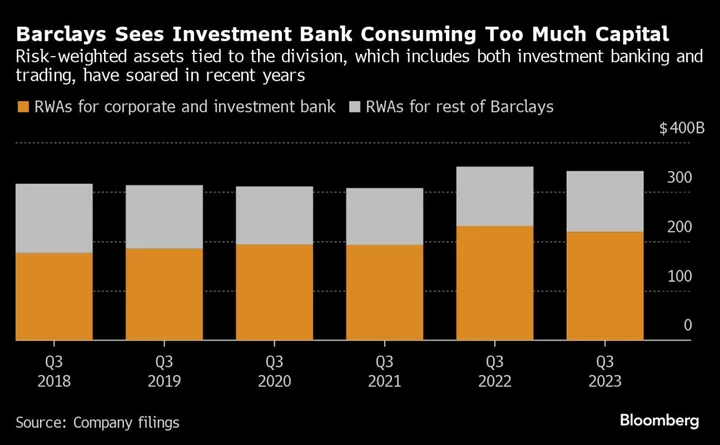

For traders and investment bankers inside Barclays Plc, the message came from on high: Their unit is sucking up too much capital relative to other parts of the bank.

It was Paul Compton, head of the firm’s corporate and investment bank, who delivered the news to his staffers in a town hall at the firm’s headquarters in London’s Canary Wharf this week, according to people who were present and asked not to be named discussing a non-public event. The answer, Compton said, was finding more profitable ways to use the capital it’s been allocated.

The gathering came as the bank’s executives mull a strategic overhaul, with executives expected to unveil a series of more ambitious financial targets in February.

The path Barclays will take to achieve those new targets is a conundrum that’s dogged Chief Executive Officer C.S. Venkatakrishnan ever since he tapped Boston Consulting Group to do a wide-ranging review of the firm’s strategy earlier this year, a move that has sparked angst among high-ranking bankers and low-level staffers alike.

A range of options are being considered, from expanding advisory business to acquiring a wealth manager, people familiar with the matter said. The bank is also mulling making a bid for a retail bank or rejiggering its approach to payments.

The deliberations indicate the range of levers Venkatakrishnan and Chairman Nigel Higgins are considering as they look to turn around the company’s lagging stock price.

Barclays comprises one of the UK’s largest retail banks as well as an international credit card business and a global investment bank. But its shares are down about 30% since Venkatakrishnan took the helm two years ago and it now trades at a paltry price-to-book ratio of 0.38, lagging rivals.

The British firm reported disappointing third-quarter earnings last month, which prompted a fresh slide in the bank’s share price. In the UK, the tailwind from higher interest rates is slowing while Barclays’ traders and investment bankers have struggled to keep pace with US peers.

The breadth of Venkatakrishnan’s strategy review shows that there is no easy fix for these woes. Even if Compton’s division has posted disappointing results at times, it’s also been a reliable source of income in times of volatility. Management has been loathe to shrink the corporate and investment bank, which means the lenders needs to expand its other operations to boost the group’s return on equity, according to Ed Firth, an analyst at Keefe, Bruyette & Woods. But at the same time, shareholders have been agitating for Barclays to increase share buybacks.

“Unfortunately they do not have enough capital for all three,” said Firth. “One has to give.”

This account is based on conversations with people familiar with the matter, who asked not to be named discussing the non-public deliberations. A spokesperson for Barclays declined to comment on the bank’s plans.

Corporate, Investment Bank

Come February, Venkatakrishnan is expected to boost targets for both return on equity and the firmwide cost-to-income ratio. The investment bank, though, will likely remain the group’s chief consumer of capital.

Barclays has spent years trying to build out the division after fending off an activist investor who was campaigning for the firm to offload it. The company now frequently ranks just behind its five large US rivals in areas like trading.

Such prominence is costly. Risk-weighted assets tied to the unit now stand at £220 billion ($199 billion), or 65% of the firmwide total. That’s up 10 percentage points from five years ago and it’s a problem for the firm’s capital ratios, which are an all-important metric that regulators use to determine how well a bank can withstand stress.

As Venkatakrishnan looks to boost returns, one option would be to ditch less profitable businesses inside the corporate and investment bank, such as the firm’s securitized products trading unit or certain capital markets divisions.

Another approach is to find ways to ensure that the group’s biggest clients are using all of the bank’s many services, rather than just relying on its balance sheet for loans. For instance, executives have instructed bankers to review ties to certain financial sponsors that have used his bank to finance their deals without taking advantage of the firm’s advisory capabilities. Betting on fee income is a staple move when rebuilding investment banks, however M&A is currently slow while a reshuffle at Barclays has seen various dealmakers exit.

Retail, Wealth Ambitions

Leaving the corporate and investment bank relatively untouched would mean growing the firm’s retail banking presence in the UK in order to meet new targets because such operations tend to consume less capital than Wall Street operations.

To that end, Barclays has weighed making a bid for Tesco Plc’s banking arm, which offers a range of credit cards, personal loans and insurance products, according to the people familiar with the matter. The firm is also mulling a purchase of a £3 billion mortgage portfolio from Metro Bank Holdings Plc.

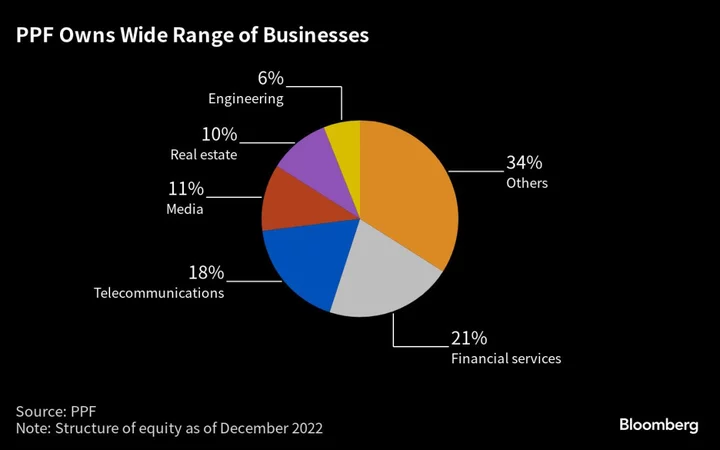

The firm is also examining rejiggering its wealth operations, either by acquiring a rival or combining its operations that cater to ultra high net worth.

Earlier this year, the company also began exploring a sale of a stake in its merchant-acquiring business in the UK. As share prices of rival payments businesses have lagged in recent months, those talks have stalled, though. It is also looking to sell its consumer-finance business in Germany.

Cost-Cutting Push

In the meantime, Venkatakrishnan and Anna Cross, the firm’s finance director, have been looking to prune costs. In the first six months of the year, the firm set aside £63 million in restructuring and redundancy costs.

Last month, Barclays warned more was to come, telling investors it was weighing taking actions that would reduce structural costs that could result in “material” charges in the fourth quarter.

Just this week, the company began telling staff that roughly 900 back-office jobs are at risk, which came amid reports that the bank is looking to reduce costs across the group by as much as £1 billion over several years.

“We are taking a number of actions to simplify and reshape the business, improve service, and deliver higher returns,” Barclays said in a statement Tuesday. “This includes changes to our headcount as management layers are reduced and the group improves its technology and automation capabilities.”

--With assistance from Harry Wilson, Donal Griffin, William Shaw and Katherine Griffiths.

Author: Jan-Henrik Förster