Some members of the Bank of Canada’s governing council argued at their last meeting that borrowing costs would need to rise further to bring inflation to heel, but policymakers agreed they “should be patient” and hold rates steady for now, before revisiting tightening in the future.

Officials decided to keep the benchmark overnight interest rate at 5% on Oct. 25 and reiterate that they’re prepared to hike again, given slower-than-expected progress on restoring price stability and mounting near-term inflation risks.

Still, according to a summary of deliberations released Wednesday, the six-person governing council believe they’re seeing supply and demand rebalance in the economy as monetary policy continues to gain traction.

“Signs were clearer that monetary policy was working to dampen spending. With demand slowing and supply catching up, the economy was approaching balance,” the bank said in the document.

The text of the discussions that led to the rate decision suggests officials increasingly think they’ve tightened borrowing costs enough to return inflation to the 2% target, but are keeping the door open to additional hikes until they get a better sense that inflation is decelerating.

Weaker demand is only slowly translating into lower price growth, they said, prompting officials to reflect on whether their aggressive hiking campaign needs more time to work through the economy, or whether they need to tighten further.

“As the economy moved into excess supply, past monetary tightening should continue to translate into lower inflation.”

Policymakers said they remain concerned about underlying price pressures — which strip out more volatile price movements – since they’ve been running between 3.5% and 4% over the last year, suggesting “little downward momentum.”

“Members noted that they needed to see downward momentum in core inflation to be confident that monetary policy was sufficiently restrictive to restore price stability.”

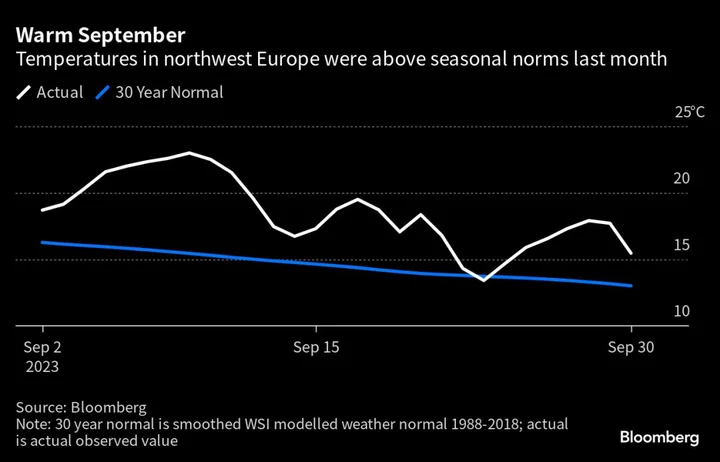

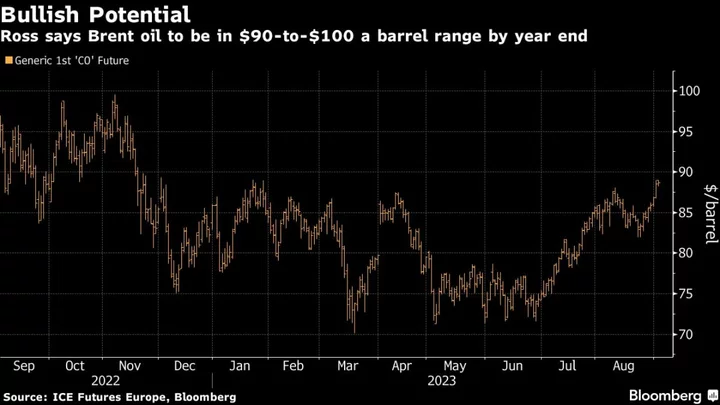

Importantly, policymakers raised their expectations for inflation in the near term, saying higher oil prices, rent and housing costs and the slow normalization of corporate pricing are limiting the disinflation process. They also noted elevated inflation expectations and wage growth.

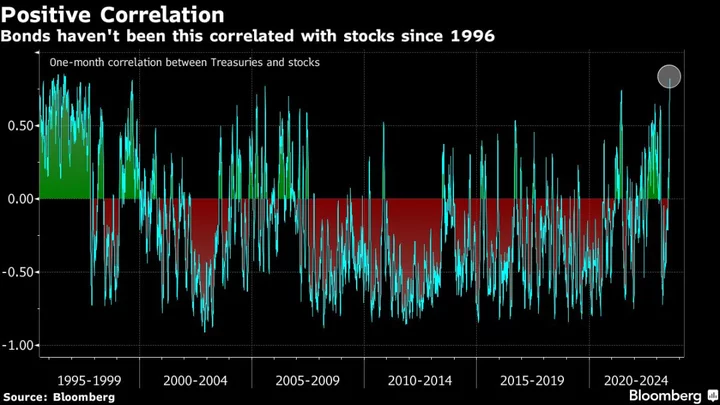

Governing council spent some time discussing possible explanations for the recent run-up in global bond yields. Markets believing in “higher for longer” policy settings from central banks, a rise in longer-term premiums due to uncertainty, deficit financing and a higher neutral rate were all offered as reasons.

Officials also reiterated that they expect federal and provincial fiscal spending to rise 2.5% in 2024, faster than growth in supply, which “could get in the way of returning inflation to target.”

In an interview with Bloomberg last week, Senior Deputy Governor Carolyn Rogers mentioned downside risks to the economy and financial system as Canada’s heavily indebted households renew their shorter-duration mortgages at much higher rates. That’s expected to reduce consumption and bring demand into a better equilibrium with supply.

As for the conditions for another hike, Rogers said upside surprises to economic growth or stickier-than-expected core inflation are something that would cause the central bank to “reflect.”

(Adds photo, decks, further detail from document starting in paragraph 10.)