Asian equities are set to rise on Tuesday following a rally in big tech that spurred a rebound on Wall Street.

Rising Treasury yields and likely upward pressure on rates in Asia may temper sentiment for risk taking as investors await a key speech later in the week by Federal Reserve Chair Jerome Powell.

Futures for Japanese shares advanced 1% while contracts for benchmarks in Australia and Hong Kong showed smaller gains. An index of US-listed Chinese stocks also rose.

The S&P 500 halted a four-day drop while the Nasdaq 100 rose about 1.5%, with Tesla Inc. up the most since March. Nvidia Corp., which helped ignite the artificial-intelligence frenzy that has driven this year’s equity surge, jumped over 8%. The chipmaker’s results are due Wednesday, and revenue is seen rising 65% from a year earlier, according to data compiled by Bloomberg.

In late US hours, SoftBank Group Corp. semiconductor unit Arm filed for what is set to be this year’s largest US initial public offering. Investors will also be watching shares of BHP Group Ltd. after the world’s biggest miner reported a 37% decline in full-year profit, missing analysts’ estimates.

Bonds resumed their selloff as signs of economic strength bolstered bets on still elevated rates. The yield on 10-year inflation-protected Treasuries pushed over 2% for the first time since 2009. Not long after, the yield on 10-year notes without that protection hit a level last seen in late 2007.

Bond yields were higher early Tuesday in Australia and New Zealand. Major currencies traded within narrow ranges.

Powell will speak Friday at the Kansas City Fed’s Jackson Hole Economic Policy Symposium after officials last month lifted rates to a range of 5.25% to 5.5%, the highest level in 22 years. Minutes from the gathering showed policymakers still saw significant risks that inflation could remain higher than they expect — which could keep rates elevated.

Two-thirds of 602 respondents in Bloomberg’s latest Markets Live Pulse survey say the Fed has yet to conquer inflation. And over 80% of those surveyed said Powell’s Jackson Hole speech will reinforce the message of a hawkish hold.

“The Fed and investors will soon pivot from a focus on how high the policy rate will go to a concern about how long they will stay at that level — and what the implications are for a ‘higher for longer’ scenario,” said Katie Nixon, chief investment officer for the wealth management business at Northern Trust.

The speeches from Fed chiefs at the Jackson Hole conference have typically buoyed stocks since the turn of the millennium, data compiled by Bloomberg Intelligence show. But last year equities slumped 3.2% in the week following Powell’s remarks after he warned of keeping policy restrictive to battle inflation.

Meantime, two of Wall Street’s top strategists are at odds about the outlook for US stocks following a three-week run of declines as debate rages over whether the economy can avoid a recession.

While Morgan Stanley’s Michael Wilson — a stalwart equity bear — says sentiment is likely to weaken further if investors are starting to “question the sustainability of the economic resiliency,” his counterpart at Goldman Sachs Group Inc., David Kostin, says there’s room for investors to further increase exposure if the economy stays on course for a soft landing.

Key events this week:

- US existing home sales, Tuesday

- Chicago Fed’s Austan Goolsbee speaks, Tuesday

- Eurozone S&P Global Services & Manufacturing PMI, consumer confidence, Wednesday

- UK S&P Global / CIPS UK Manufacturing PMI, Wednesday

- US new home sales, S&P Global Manufacturing PMI, Wednesday

- US initial jobless claims, durable goods, Thursday

- Kansas City Fed’s annual economic policy symposium in Jackson Hole begins, Thursday

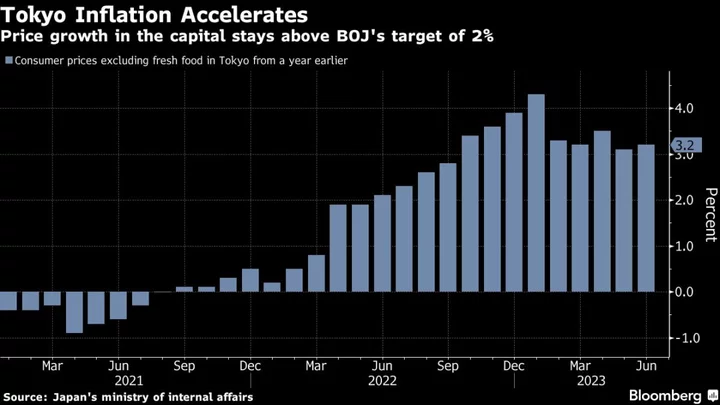

- Japan Tokyo CPI, Friday

- US University of Michigan consumer sentiment, Friday

- Fed Chair Jerome Powell, ECB President Christine Lagarde to address Jackson Hole conference, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 7:40 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 rose 1.7%

- Nikkei 225 futures rose 1%

- Australia’s S&P/ASX 200 Index futures rose 0.2%

- Hang Seng Index futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was unchanged at $1.0896

- The Japanese yen was little changed at 146.19 per dollar

- The offshore yuan was little changed at 7.2881 per dollar

- The Australian dollar was little changed at $0.6415

Cryptocurrencies

- Bitcoin rose 0.1% to $26,147.17

- Ether fell 0.2% to $1,669.21

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 4.34%

- Australia’s 10-year yield advanced four basis points to 4.30%

Commodities

- West Texas Intermediate crude rose 0.3% to $80.93 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.