Stocks in Asia traded mixed following a stall in the US rally and Big Tech’s decline. Nvidia Corp. slipped in late trading after reporting earnings.

Mainland Chinese shares fell at the open, while tech stocks in Hong Kong gained, partially supported by Baidu Inc. that rose more than 5% after releasing better-than-expected third-quarter results. US equity futures edged lower after the Nasdaq 100 Index sank 0.6% Tuesday, with Apple Inc, Microsoft Corp. and Amazon.com Inc. all dropping.

Asian artificial intelligence stocks slipped after Nvidia’s latest set of results blew past average analyst estimates but got a tepid reaction from investors who have bet heavily on the AI boom. Also, the company said it expects sales in China to decline significantly in the fourth quarter amid US curbs on exports to the country.

Among areas of focus in Asia is China’s latest probe into company executives after the arrest of game-streaming company DouYu International Holdings Ltd.’s founder Chen Shaojie on unspecified charges. A series of unexplained executive detentions have created jitters across the country’s private sector.

Geopolitics is still in focus too. Israel’s deal with Hamas will free about 50 hostages in return for a four-day pause in fighting in the Gaza Strip, and some Palestinians will be released from Israeli prisons.

Meanwhile, the offshore yuan extended its winning streak into a fifth day after China’s central bank set the currency fixing at the strongest level since June. The yuan had jumped beyond the daily reference rate for the first time since July in the previous session.

Treasuries steadied in Asian hours after climbing Tuesday, led by the shorter end. The dollar traded in narrow ranges against its Group-of-10 peers. The yen ticked slightly higher.

The Fed’s minutes released Tuesday show policymakers united around a strategy to “proceed carefully” on future interest-rate moves and base any further tightening on progress toward their inflation goal. Swap contracts linked to Fed meetings currently price in around 25% probability of a first Fed rate cut in March.

“We should not attach too much value anymore to the remaining hike that is implied in the September dot plot,” Philip Marey, senior US strategist at Rabobank, wrote in a note. “If we were to see stronger economic and inflation data before the December meeting, longer-term rates are likely to rebound and substitute for a rate hike. Therefore we do not expect further hikes.”

Popular Bets

US benchmarks are still up for 2023. The S&P 500 has added $6 trillion of market capitalization on the back of the artificial intelligence boom, Corporate America’s resilience and bets the Federal Reserve will pivot to rate cuts next year. It’s now about 5% away from reclaiming its record high.

Hedge funds are holding their most-concentrated wagers on US equities of any time in the past 22 years, according to data from Goldman Sachs Group Inc. The most popular bets remain in megacap tech, with Microsoft Corp., Amazon.com Inc. and Meta Platforms Inc. in Goldman’s list of “Hedge Fund VIPs” this quarter.

To Savita Subramanian at Bank of America Corp., the S&P 500 is set for a fresh high in 2024 because US companies have adapted to higher rates and weathered macroeconomic jolts. She sees the gauge at a record 5,000 by the end of 2024, about 10% higher than Tuesday’s close. Next year will be “a stock picker’s paradise,” she said.

Elsewhere, oil steadied, with signs of another stockpile build in the US coming ahead of an OPEC+ meeting on supply over the weekend.

Cryptocurrencies were down as Binance Holdings Ltd. and its CEO Changpeng “CZ” Zhao, pleaded guilty to antimoney-laundering and US sanctions violations under a sweeping settlement with the US. The deal allows Binance to continue operating, though Zhao stepped down as CEO and will be replaced by Richard Teng. Bitcoin fell as much as 3.2% to $35,663, and Ether declined as much as 2.8% to $1,930.75.

Key events this week:

- Eurozone consumer confidence, Wednesday

- US initial jobless claims, University of Michigan consumer sentiment, durable goods, Wednesday

- Bank of Canada Governor Tiff Macklem speaks, Wednesday

- Eurozone S&P Global Manufacturing & Services PMI, Thursday

- Thanksgiving holiday — US markets closed — Thursday

- ECB publishes account of October policy meeting, Thursday

- Black Friday, traditional kickoff for the US holiday shopping season

- ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 10:45 a.m. Tokyo time. The S&P 500 fell 0.2%

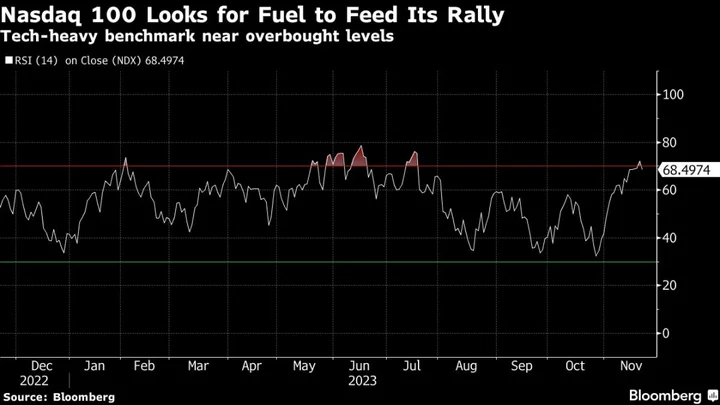

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 fell 0.6%

- Japan’s Topix index rose 0.6%

- Hong Kong’s Hang Seng Index was little changed

- China’s Shanghai Composite Index fell 0.1%

- Australia’s S&P/ASX 200 Index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0912

- The Japanese yen was little changed at 148.28 per dollar

- The offshore yuan was little changed at 7.1414 per dollar

- The Australian dollar was little changed at $0.6558

Cryptocurrencies

- Bitcoin fell 1.8% to $36,167.75

- Ether fell 1% to $1,966.28

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.40%

- Japan’s 10-year yield advanced 0.5 basis point 0.700%

- Australia’s 10-year yield declined one basis point to 4.43%

Commodities

- West Texas Intermediate crude rose 0.1% to $77.88 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth, Rob Verdonck and Toby Alder.