Amazon.com Inc. is in talks to join other tech companies as an anchor investor in Arm Ltd.’s initial public offering, according to a person familiar with the situation, part of preparations for a deal that could raise as much as $10 billion.

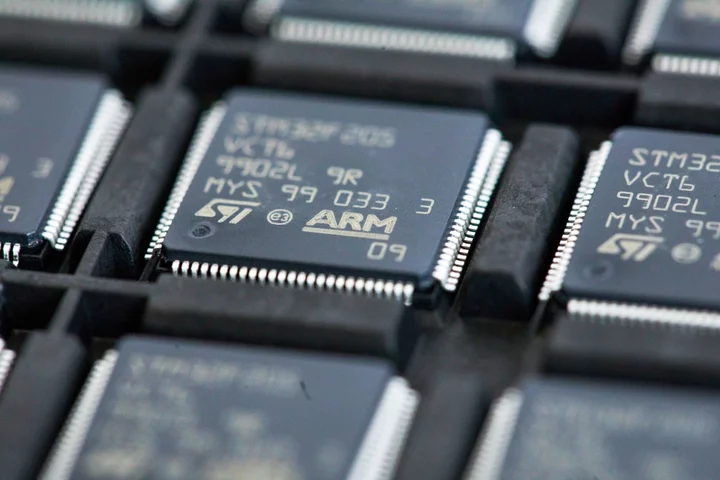

Amazon is one of several tech companies that have talked to Arm about backing the offering, which is expected next month, said the person, who asked not to be identified because the deliberations are private. Arm, a chip designer that counts the world’s biggest tech firms as its clients, also has held discussions with Intel Corp. and Nvidia Corp.

Representatives for Amazon and Arm declined to comment. Reuters previously reported on the talks with Amazon.

Arm, owned by SoftBank Group Corp., is gearing up for what promises to be the biggest tech IPO of the year. It’s spent months talking to some of its top customers about joining the offering, Bloomberg has reported. Amazon, with its sprawling Web Services operation, is one of Arm’s largest clients, favoring Arm-based chips because of their cost and efficiency. The technology is relied on by 40,000 Amazon customers.

Bloomberg reported last week that Arm is targeting an IPO at a valuation of $60 billion to $70 billion as soon as September, aiming to bank on the popularity of AI chips. The roadshow is scheduled to start the first week of next month, with pricing for the IPO coming the following week, a person familiar with the matter has said. Japan’s SoftBank acquired the chip company in 2016 for $32 billion.

At the top end of estimates, Arm’s IPO would be the largest from the tech industry since Alibaba Group Holding Ltd. in 2014 and Meta Platforms Inc. — then Facebook Inc. — in 2012. It’s slated to arrive during a slow stretch for IPOs, which have been sidelined because of an uncertain economy and the war in Ukraine.