The benchmark emerging-market stocks gauge took a hit from large declines in a pair of Chinese e-commerce shares on Friday, paring the best month for equities in developing countries since January.

The losses in Hong Kong-traded Alibaba Group Holding Ltd. and its main rival Tencent Holding Ltd. pared the weekly advance in the index to 2.9% as of 10 a.m. in London, and the monthly gain to 6.6%. Alibaba, which dropped 10% after scrapping a plan to carve out its cloud unit, citing US restrictions on chip exports, accounted for about 40% of the index’s 0.5% loss on Friday.

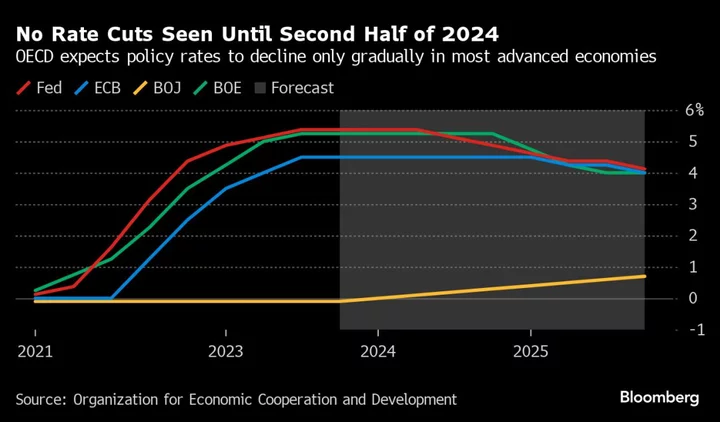

The MSCI emerging-market currency index, meanwhile, rose for a fourth day in its longest streak of gains since Oct. 11, adding 0.3% on the day to notch the monthly increase up to 1.9%, also the largest since January. Emerging-market assets have rallied in the week on softer-than-expected US inflation data, which led investors to bet that the Federal Reserve’s monetary tightening is over.

The Thai baht, Kenyan shilling and Taiwanese dollar were the best performers among emerging-market peers on Friday while the Zambian kwacha, Hungarian forint and Polish zloty underperformed. The Russian ruble, Chilean peso and Israeli shekel were the best performers in the week, each rising at least 3.5%.

Central Banks

Pakistan dominated the ranks of best-performing dollar bonds on Friday, extending gains since the International Monetary Fund indicated on Wednesday that it’d give the country access to about $700 million in funding, helping it to avoid defaulting on its debt. The bonds maturing in June 2026 have risen more than 5 cents on the dollar this week and on Friday traded above 60 cents for the first time in more than a year.

Oil headed for a weekly drop of about 5% after sinking into a bear market, muddying the outlook for a meeting of the Organization of Petroleum Exporting Countries at the end of next week. The cartel is expected to push for more cuts in a bid to reverse declining prices, with Brent crude trading at around $78 a barrel early on Friday.

For next week, emerging-market investors will be keeping an eye on monetary policy decisions in Indonesia, Nigeria, South Africa, Sri Lanka and Turkey. The central banks in Turkey and Nigeria are likely to lift their main policy rates by 200 basis points each, while South Africa’s central bank will likely keep its repo rate unchanged, according to forecasts by Bloomberg Intelligence.

S&P Global Ratings is scheduled to review South Africa’s credit rating after today’s close of trading. The country faces an elevated risk of slipping deeper into junk territory after S&P cut the outlook on its debt to negative on concerns over a wider-than-anticipated budget deficit.

Indonesia is expected to leave its 7-day reverse repo rate unchanged at 6% while the Central Bank of Sri Lanka could cut its lending and deposit rates by 100 basis points each to 10% and 9%, respectively, on Nov. 24, according to BI.

Serial defaulter Argentina will hold a runoff presidential election on Sunday, pitting Economy Minister Sergio Massa against libertarian firebrand Javier Milei, who has vowed to completely upend the economy. Holders of some $65 billion of the nation’s sovereign debt are worried, after seeing the bonds lose roughly $24 billion in value since the last restructuring in 2020.

Author: Anthony Osae-Brown