Alibaba Group Holding Ltd.’s cloud division is weighing a private round to raise funds from Chinese state-owned enterprises ahead of the business’s market debut in Hong Kong, people with knowledge of the matter said.

The tech giant is working with advisers on a potential Cloud Intelligence Unit fundraising that could raise about 10 billion yuan to 20 billion yuan ($1.4 billion to $2.8 billion), according to the people. Prospective investors include state-backed telecommunication companies, they said.

Alibaba planned to spin off the unit by distributing a stock dividend to shareholders within 12 months, the company announced in May. Raising funds from state-owned firms could increase the chances of winning new government cloud contracts, boosting the use of Alibaba’s related services, Bloomberg Intelligence analysts Catherine Lim and Marvin Lo wrote in a note on Tuesday. With the potential deal, a listing may value the cloud unit at more than $55 billion, they added.

Deliberations are preliminary and details of the financing such as size and timing could change, the people said, asking not to be identified as the information is private. A representative for Alibaba didn’t respond to an emailed request for comment. Spokespeople for China’s three main state-owned telecom operators didn’t respond to requests for comment.

Shares of Alibaba fell as much as 1.2% in Hong Kong on Tuesday.

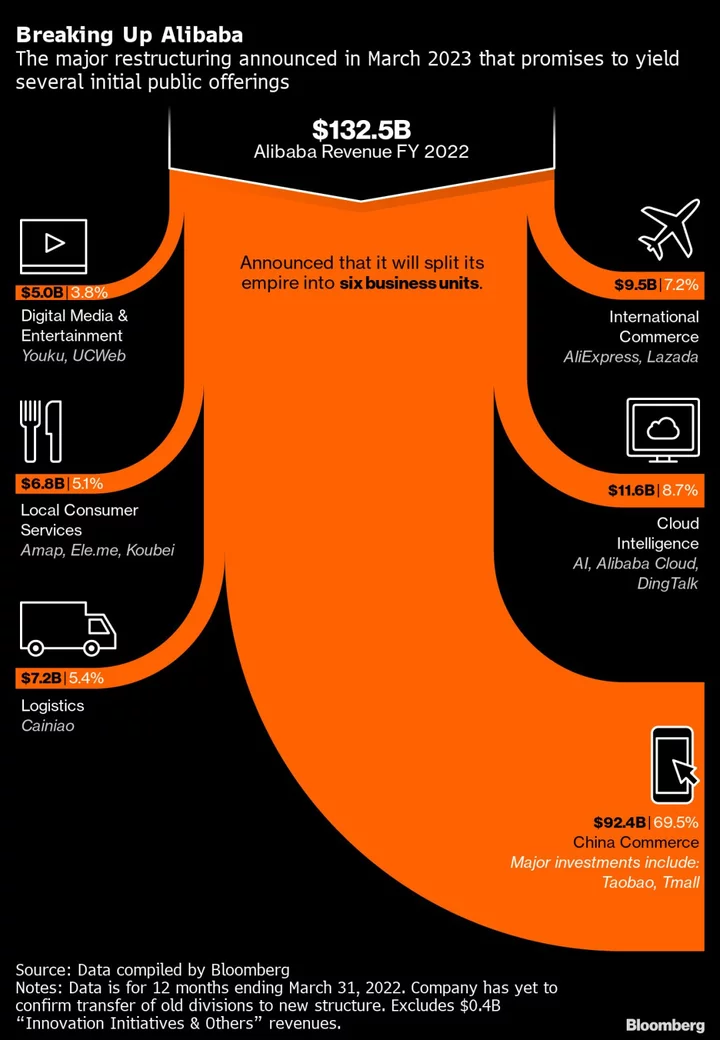

Alibaba dropped a bombshell when it announced the e-commerce leader would split into six mostly independent pieces, with businesses such as logistics and smart retail set for initial public offerings. A listing by way of introduction for Cloud Intelligence Group would not involve raising new money by selling shares to the public. But selling stakes to China’s so-called national team ahead of the spin-off could alleviate Beijing’s security concerns around the business.

Read more: China’s Tech Crackdown Is Ending. What Does It Mean?: QuickTake

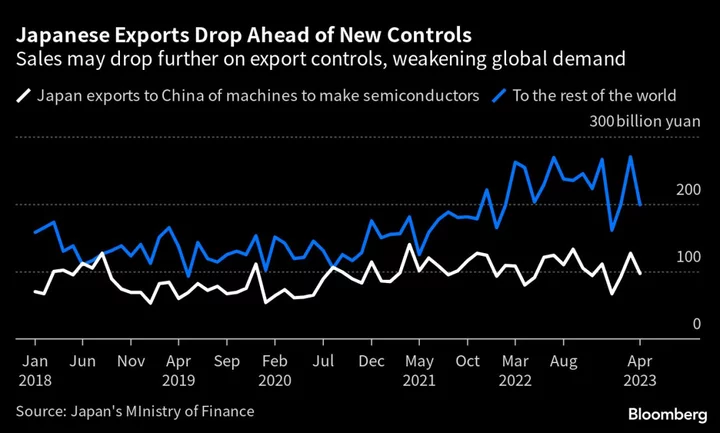

The cloud business, a thriving operation and China’s closest analog to Amazon Web Services, drew regulators’ ire in 2021 when it shared its discovery of a major software flaw with a global developer community before it informed the authorities. It was investigated a year later for its role in China’s largest known cybersecurity data leak. The cloud division in recent years began to bleed market share to rivals including Huawei Technologies Co. and state-run China Mobile Ltd.

Founded in 2009, the business known as Alibaba Cloud provides data processing and storage services to thousands of businesses, developers and government organizations in more than 200 countries and regions, according to its website. It contributed $11.2 billion of revenue to Alibaba in the 12 months to March 31, excluding payments from other businesses within the group.

In July, Alibaba Cloud introduced large language model Tongyi Wanxiang, whose name means 10,000 images, at a conference. The generative AI model can create a variety of visuals ranging from animation and sketches to 3D cartoons, according to a statement.

--With assistance from Jane Zhang and Shirley Zhao.

(Adds Bloomberg Intelligence analyst comment in third paragraph and Alibaba share moves in fifth paragraph.)