By Ankur Banerjee

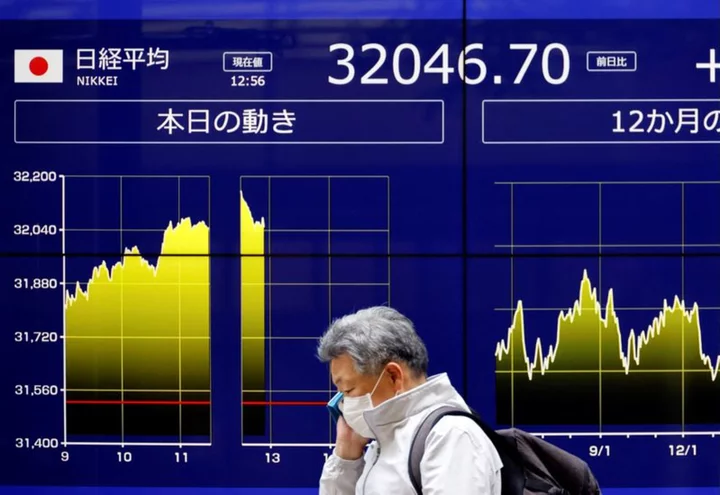

SINGAPORE (Reuters) -Asian shares edged higher on Tuesday ahead of a crucial U.S. inflation report that could heavily influence the Federal Reserve's policy outlook, while the fragile yen flirted with 33-year lows, putting it back in the intervention zone.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.23% higher, on course for its second straight day of gains.

The Japanese yen was at 151.71 per dollar in Asian hours, having touched a one-year low of 151.92 on Monday. If the battered currency breaks below last year's trough of 151.94, it would mark a fresh 33-year low. [FRX/]

Japanese Finance Minister Shunichi Suzuki said on Tuesday that the government would take all the necessary steps to respond to currency moves, repeating his usual mantra that excessive swings were undesirable.

European shares are also expected to remain listless, with Eurostoxx 50 futures down 0.05%, German DAX futures down 0.01% and FTSE futures 0.15% lower.

Investors are waiting for the U.S. inflation report, due later in the day, after Federal Reserve Chair Jerome Powell and other policymakers said they are still not sure that interest rates are high enough to tame inflation.

Economists polled by Reuters expect headline U.S. consumer price inflation to have slowed to 3.3% in October from 3.7% in September, with the so-called core inflation rate that strips out volatile components unchanged at 4.1%.

"This data holds significant sway over the Federal Reserve's future policy direction," said Anderson Alves, a trader with ActivTrades.

"A miss, especially in the less volatile core inflation component, might lead traders to believe the Fed could refrain from further hikes. Conversely, a beat could prompt a noticeable repricing on the short-term U.S. interest curve."

China shares were marginally lower, with the blue-chip CSI 300 Index down 0.19% while Hong Kong's Hang Seng Index was up 0.09%, ahead of a summit between the top leaders from the world's two largest economies later this week.

Benchmark 10-year Treasury yields was at 4.630%, easing a touch from Monday's one-week peak of 4.696%. [US/]

Markets have mostly taken in their stride Moody's move to cut its U.S. AAA credit rating outlook to "negative" from "stable" on Friday. Moody's decision comes after rival Fitch downgraded the U.S.'s top credit rating in August.

"With the presidential election just a year away, it's unlikely that the government will announce significant proposals to address these issues, given the unpopularity of promising spending cuts and tax increases," said Gary Dugan, Chief Investment Officer at Dalma Capital.

The U.S. faces another partial government shutdown beginning Saturday if Congress does not pass a stopgap spending bill.

YEN WATCH RESUMES

The yen's broad decline has traders back to keeping an eye on whether the Japanese authorities will intervene, with the U.S. inflation data the likely trigger for the next major move.

Japan last intervened in the currency market - selling dollars and buying yen - in October last year. Intervention data released last month showed the authorities have steered clear of further such action since then.

The currency is down about 14% against the dollar so far this year.

The yen had jumped briefly against the dollar in New York hours on Monday after striking the year-to-date low, which analysts attributed to a flurry of trading in options that come due this week.

Nicholas Chia, macro strategist at Standard Chartered, said the swings in the yen suggest markets are worried about a possible intervention, helping to curb excessive speculation.

"In a way then, market participants are doing the Ministry of Finance's job for them as markets start second-guessing the price action behind any sudden decline in dollar/yen," he said.

The dollar index, which measures the U.S. currency against six rivals, was up 0.057% at 105.69. The index is down 1% in November, on course to snap its three-month winning streak.

Oil prices was slightly higher after an OPEC report said market fundamentals remained strong. U.S. crude rose 0.27% to $78.47 per barrel and Brent was at $82.73, up 0.25% on the day. [O/R]

(Reporting by Ankur BanerjeeEditing by Shri Navaratnam and Miral Fahmy)